The NASDAQ 100 rallied again during the trading session on Tuesday as we broke above the 12,600 level in late trading. The NASDAQ 100 will continue to be a favorite due to the “work from home” trade, and now that we are seeing Boston and New York locking down along with London, it is likely that we will see more profits for these types of companies.

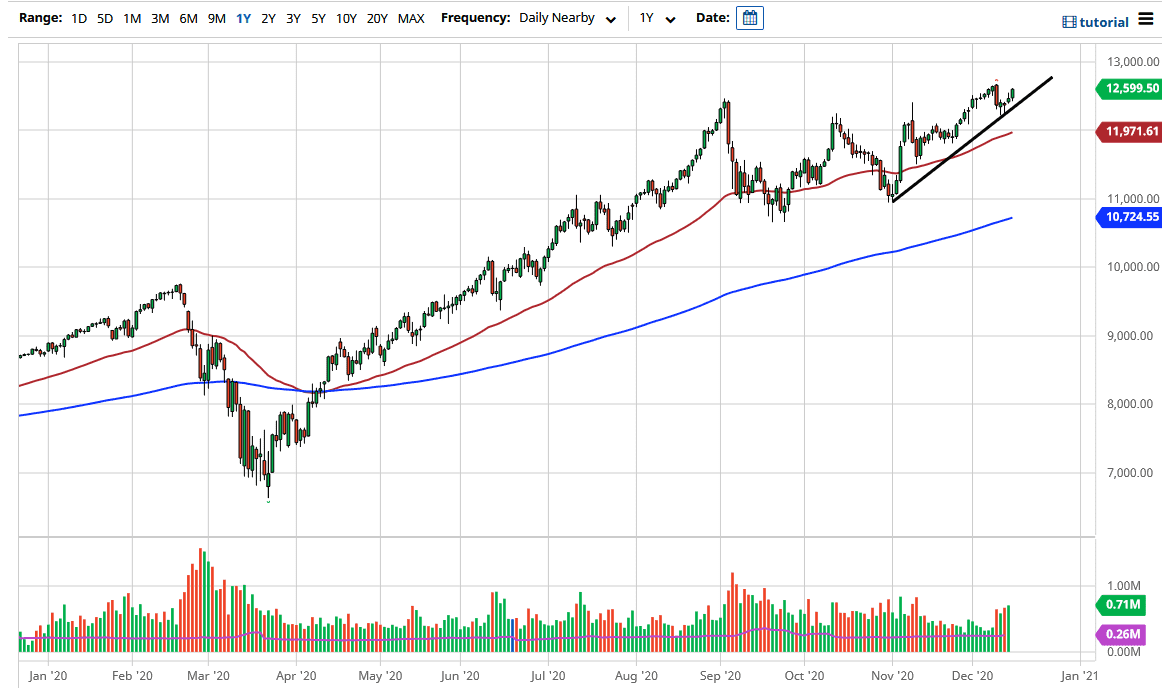

The uptrend line that I have drawn on the chart should be crucial for the short term, but keep in mind that the Federal Reserve has a significant amount of influence on the markets. With the Federal Reserve trying to support the economy with its announcement on Wednesday, people may continue running towards the stock markets in general as new forms of quantitative easing could be on the docket. Beyond that, we also have stimulus coming from Congress, which has a certain amount of influence on the currency, which in turn has a certain amount of influence on risk appetite and people looking for ways to take advantage of devalued currency.

Even if we break down below the uptrend line, the 50-day EMA near the 12,000 level will also offer support. This is going to be a “buy on the dips” situation, and we will eventually go looking towards the 13,000 level, possibly even the 14,000 after that. This market will have one more explosive move to the upside heading into the end of the year as the “Santa Claus rally” comes back into play. You should be looking for short-term pullbacks in order to take advantage of value as it occurs. The NASDAQ 100 has been an absolute beast for the year, and based upon the recent measured move, 14,000 is a very likely target. While we are probably a bit overdone, the reality is that longer-term traders will continue to see support, so we will grind to the upside. The candlestick from the Tuesday session was a huge sign that a lot of people are waiting to do just that.