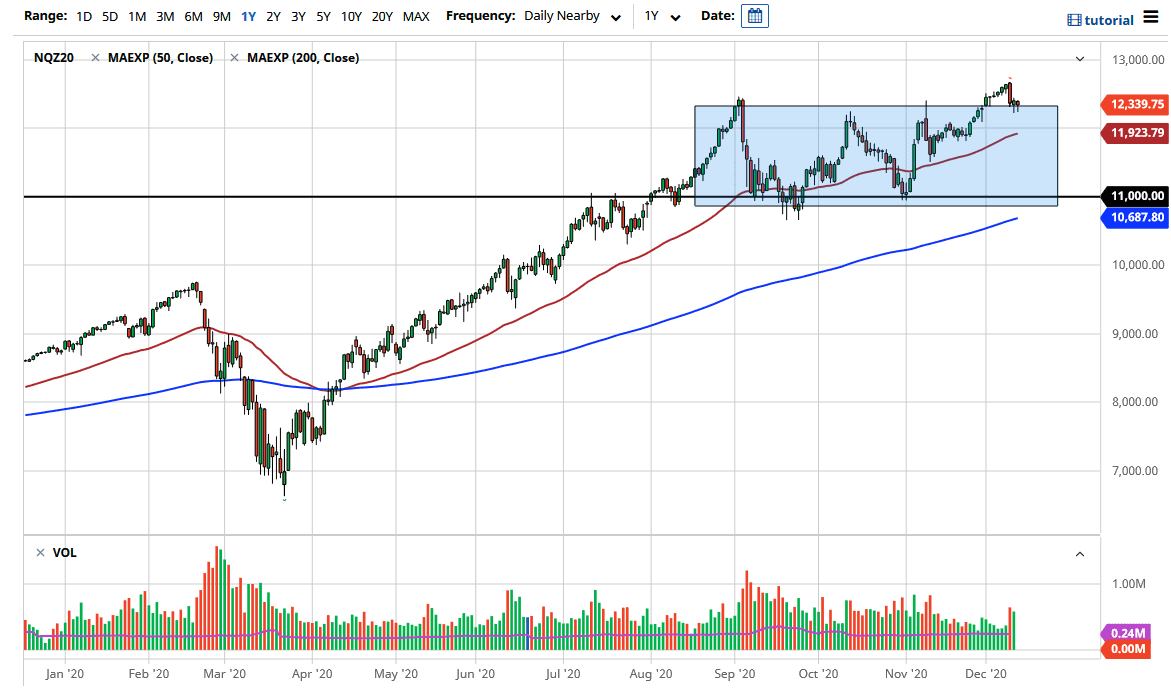

The NASDAQ 100 fell a bit during the trading session on Friday as traders continue to worry about stimulus coming out the United States. By the time Europe went home, the Americans started to buy the market again, so the NASDAQ 100 formed a hammer. It looks as if the 12,300 level is offering significant support, and therefore the fact that we have formed a couple of hammers is worthy of attention. If we were to break down below those hammers, that would obviously shift the market to being a bit negative.

The 50-day EMA sits just below the 12,000 handle, and given enough time, that would also offer support. So even if we do get that breakout I mentioned previously, I have no interest in shorting this market. Remember, the NASDAQ 100 moves on a handful of stocks that everybody loves, so it follows that we will eventually go higher. We also have the “Santa Claus rally”, which makes it very likely that we will continue to see buyers jump in in order to push returns higher to report to clients.

To the upside, the 13,000 level is an area to which people will be paying close attention and perhaps targeting. Between here and there, the 12,600 level has been resistance, so if we can take out the Wednesday candlestick, that almost ensures that we will go to the 13,000 handle. We probably need stimulus to make that happen, however, because the market is simply waiting to see whether or not the US government is going to step in and save everyone. Having said that, we are still looking at the post vaccine world, so many people are starting to price in that as well. This comes down to the US dollar and risk appetite, both of which have taken a bit of a pause over the last couple of days, but nothing that I would call terminal at this point. Buying the dips should continue to work, at least until the end of the year when everybody reports their numbers. In fact, it is not until we break down below the 11,000 level that I would be concerned about this market.