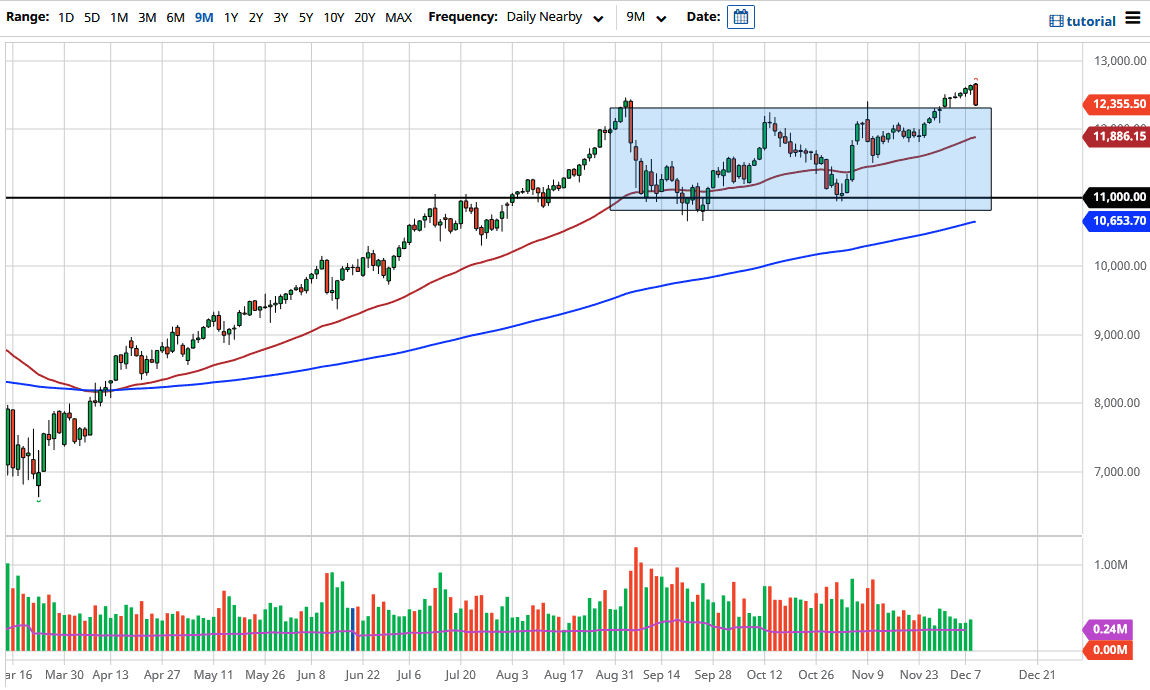

The NASDAQ 100 broke down significantly during the trading session on Tuesday as the “risk off” trade came back into play, and the NASDAQ 100 got absolutely crushed. The market closed near the 13,150 level, and it now looks as if we are testing the breakout point from previous trading. However, one thing that is a bit concerning is the fact that the candlestick for the day wiped out the previous four or five. This is not to say that we are necessarily going to melt down, but it is obvious to me that the market is facing a lot of headwinds. We will see buyers come in eventually, but you are better served to stand on the sidelines and wait for a supportive daily candlestick.

Part of what is going on is the fact that the stimulus arguments continue, so people are concerned regarding its resolution. Wall Street moves on stimulus more than anything else, so if we do not get any stimulus, then the market is likely to continue taking. But between now and then there are plenty of areas in which buyers might be interested. The 12,000 level is the first place that comes to mind, and the 50-day EMA sitting just below there would offer support as well. The size of the candlestick for the day is rather impressive, but we are still very much in an uptrend, and let's be honest here: we have seen this movie before.

Sooner or later, we will get good news regarding a stimulus which would cause the market to go ripping to the upside. We are a bit overextended at this point, so this pullback makes perfect sense and I look at it as a potential buying opportunity. But I would wait until we get a daily candlestick that tells us it is time to get long again. However, I have no interest in shorting this market, because the NASDAQ 100 is highly volatile and explosive to the upside at the slightest hint of growth or stimulus.