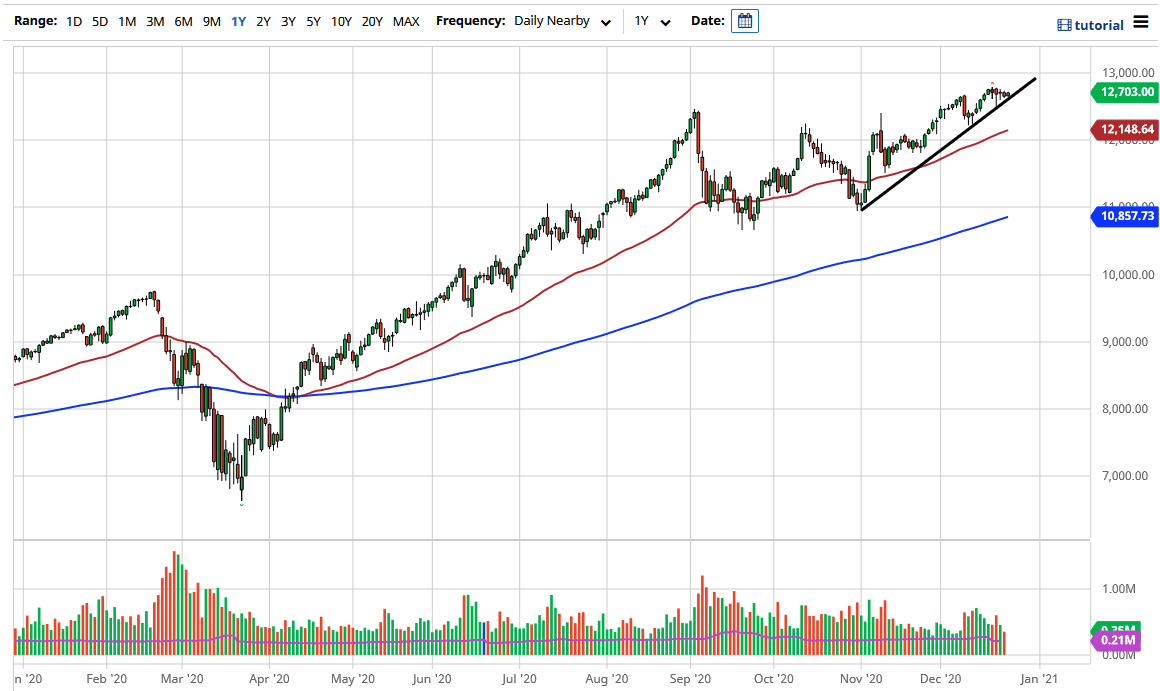

The NASDAQ 100 has been very quiet during the trading session on Thursday, as it was most of the week. After all, it was the week of Christmas, so it was going to be very thin as far as volume is concerned and I would not read too much into the price action over the last week. This is a market that continues to be very strong overall, as the same handful of stocks get bought into time and time again.

Even if we were to break down below the uptrend line, I do not have an interest in shorting the NASDAQ 100, because that is tantamount to throwing money down a hole. It seems as if the market has sudden outbursts that send it lower, only to turn around and find buyers. On signs of exhaustion, it is likely that we will continue to go higher. The 50-day EMA sits at the 12,148 level, and it is likely that we will continue to see technical traders buying in that general vicinity, not only due to that, but also due to the 12,000 level offering previous resistance and being a large, round, psychologically significant figure.

Stimulus is very bullish for stocks and is getting done in Washington DC. There is probably a bit more of a “risk on” type of attitude due to the fact that Brexit is finally settled. This is an opportunity to play the “risk on” trade as well. At this point, it is simply a matter of taking advantage of value as it occurs, on dips. We are in a longer-term uptrend, and the market is likely to go looking towards the 13,000 level, possibly even the 14,000 level based upon the measured move of the breakout of the consolidation previously. I will not short this market, although we could have the occasional negative day due to a rotation out of a handful of major stocks. Longer term, though, stock traders are set to go long in the markets due to stimulus overall. It has been rather noisy over the last week or two, and tight as well. Nonetheless, it is simply a matter of killing time after a nice shot higher.