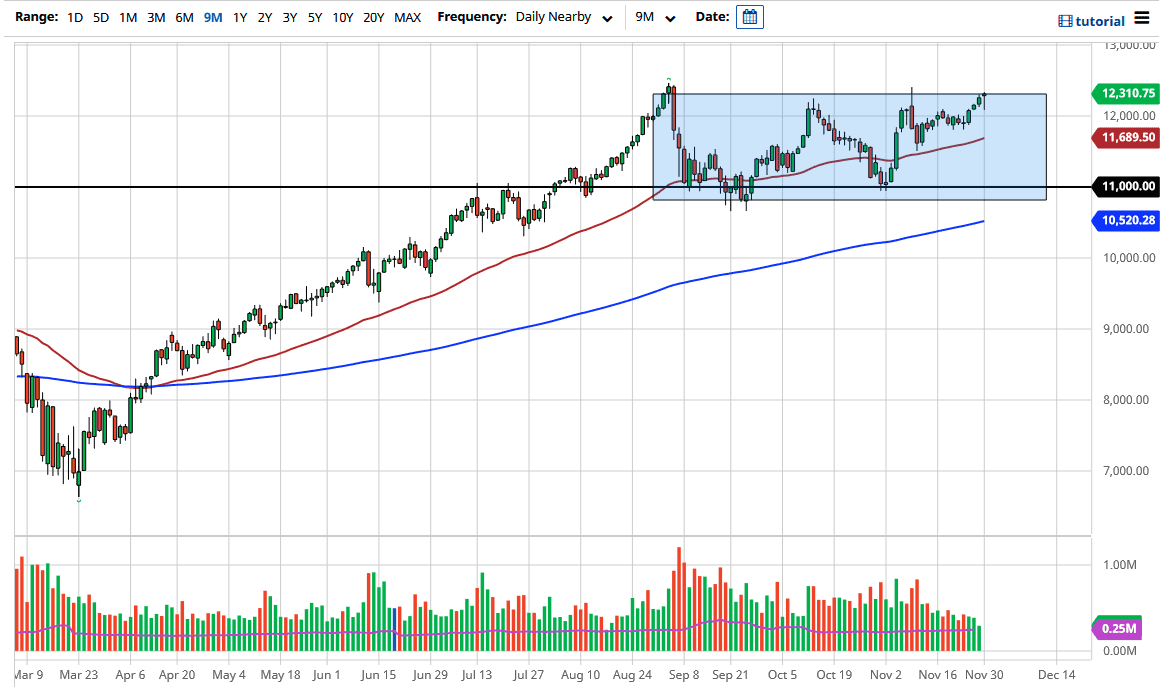

The NASDAQ 100 pulled back during the trading session rather drastically, but then turned around just as drastically to show extreme signs of strength. If we can break above the top of the candlestick for the trading session on Monday, then we will likely continue to go much higher. The market will probably attempt to break above the 12,500 level, perhaps breaking out to a much higher level eventually. When you look at the measured move, we could be looking at 14,000 when all is said and done.

To the downside, if we were to break down below this candlestick, it would essentially be a “hanging man”, which is a negative sign. The 50-day EMA underneath should be thought of as potential support as well, not to mention the 12,000 level which is above there. With that in mind, I like the idea of buying dips going forward, which has been the case in the NASDAQ 100 for quite some time.

The handful of Wall Street darlings continue to drive this market higher, so at this point you have no idea when shorting this market. The most recent pullback had been much shallower than the one before it, which was the first sign that we were going to continue to see buyers jump in. Buyers will get involved and push this to a fresh, new high. Once they do, I anticipate that we will get a surge higher, as this level just above has been difficult to deal with.

On the other hand, if we were to break down below the 50-day EMA, it is possible that we could drop down to the 11,000 level, but it seems to be very unlikely. At that level, there would be a massive amount of support and plenty of buyers in that area. This market is setting up to break out and continue the overall uptrend that we have been in, which continues to be the main driver of this market going forward. I have no interest in shorting.