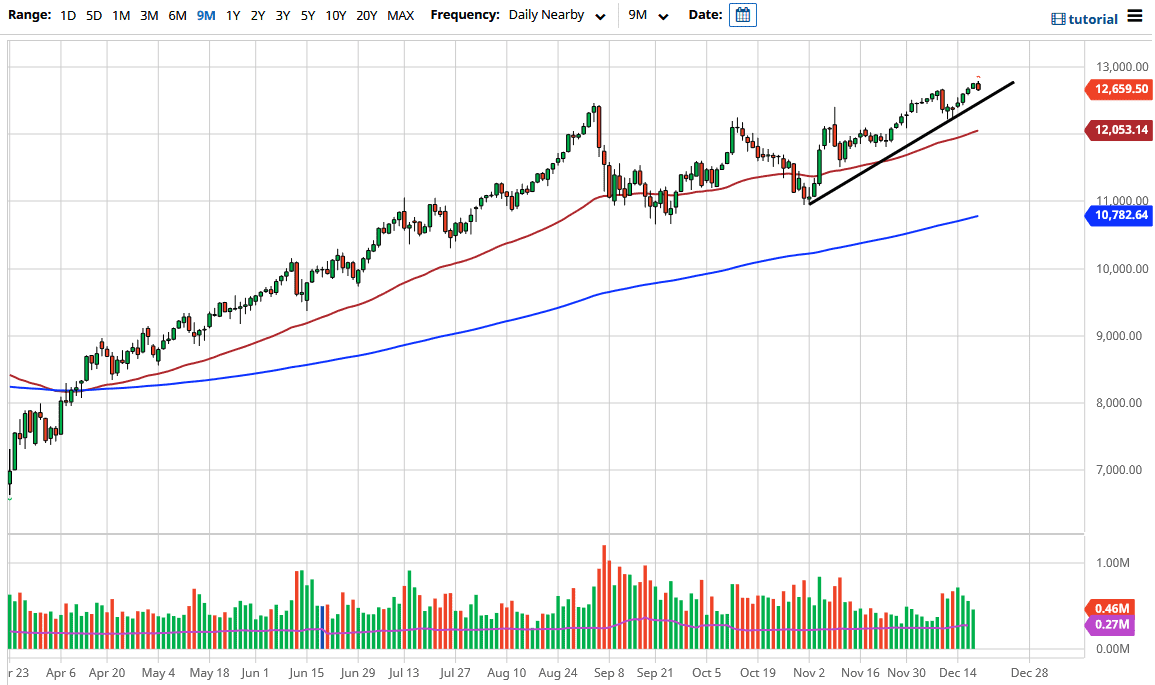

The NASDAQ 100 pulled back a bit during the trading session on Friday as we are going through “quad witching”, which is when four different options markets expire at the same time. This causes extreme amounts of volatility, so it should not be surprising to see this market simply chop back and forth. Furthermore, we are heading towards Christmas week, and that means that people will be looking towards holidays and not trading. Thus, there is little reason to get overly excited about trading, so it follows that we would see very little action.

The trend line underneath is still holding, and we are simply pulling back from all-time highs, so it is not exactly as if the markets in trouble. Over the longer term, I think that we will go towards the 13,000 level, but the next couple of trading sessions will feature very thin conditions and therefore could have somewhat erratic momentum in both directions. However, even if we do break down below the uptrend line, it is likely that the 50-day EMA would come into play, which is near the 12,000 level and gaining. This is a market that eventually will see reasons to rally, regardless of what happens. After all, stimulus is in the pipeline, and so are a handful of other potential market-moving events like Brexit and the “stay-at-home” trade that seems to work so well with the NASDAQ.

Longer term, I believe that we will go looking towards the 14,000 level, which is a large, round, psychologically significant figure and a significant amount of distance from here. If we can get to that level, a lot of people will be taking profit as well, but it is probably more or less going to be an argument for next year and not necessarily something that we are going to see in the short term. This market will continue to see plenty of momentum traders pushing it higher, because the NASDAQ 100 almost always finds a reason to gain due to the fact that it is not equally weighted.