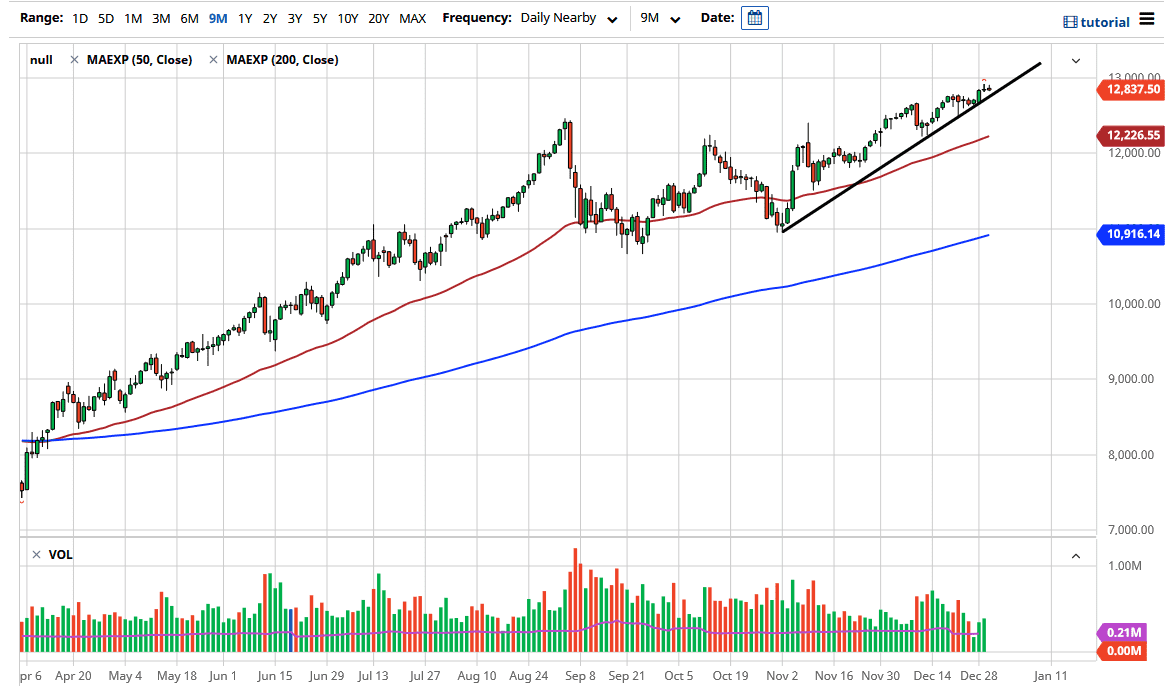

The NASDAQ 100 is sitting just below the crucial 13,000 level, which will attract a lot of attention. The market's attempt to rally during the trading session and give back some of the gains during the day on Wednesday shows that we are continuing to struggle. The uptrend line has been followed quite closely, and now that we are approaching it, we could see a bit of hesitation to break down below there.

Even if we do break down below the uptrend line, I have no interest in trying to short this market, because there is so much in the way of support underneath, such as the 12,500 level and the 50-day EMA near the 12,226 level. That is an area to which a lot of people will be paying close attention. Itis only a matter of time before value hunters come back in and try to pick this market up. The NASDAQ 100 has been elevated due to the fact that a lot of people are chasing the “stay-at-home trade”, but one thing that is worth paying attention to now is that Mitch McConnell has introduced a repeal of Section 230 into the Senate discussions about the $2000 stimulus check. This is the exemption that certain social media platforms such as Facebook and Twitter enjoy, as they are not considered to be publishers. They are not necessarily held liable for what is printed on them, but they have been very active in editorializing what has been on the platforms. Crossing this line could be the beginning of major changes for those companies. They will have an outsized effect on the NASDAQ 100.

Regardless, even we break down, I think it offers opportunities. Otherwise, if we break above the 13,000 level, people will be buying as well as it would be a move to the upside based upon momentum. Keep in mind that the trading session on Thursday is going to be shortened to come in very thin.