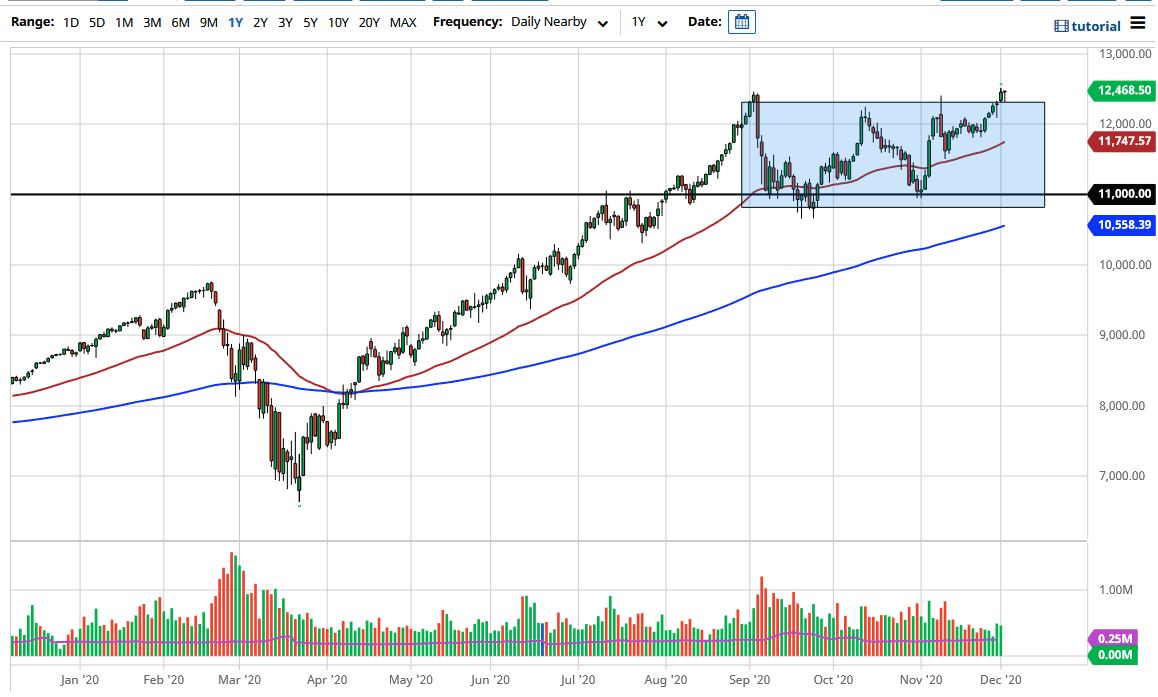

The NASDAQ 100 pulled back a bit during the trading session on Wednesday, but continues to find buyers on dips as the market has been so strong as of late. The market continues to see a lot of money flow into the “stay-at-home stocks” that make up a majority of the big players in this index. Remember, the NASDAQ 100 is not equally weighted, meaning that just a handful of stocks can move the majority of the index. I like the idea of buying these pullbacks, as it looks like the breakout above the 4500 level is imminent. Furthermore, the 12,000 level underneath should be a massive support level as well.

The 50-day EMA is starting to reach towards that 12,000 handle, and that will solidify that support as well. We are seeing an opportunity to pick up short-term value every time we pull back, because it is very likely that longer term we will go looking towards the 13,000 level and possibly even the 14,000 level, based on the measured move of the range from which we are trying to break out. The NASDAQ 100 will continue to lead stock markets higher based upon liquidity and simple momentum.

However, the jobs number coming out on Friday will probably keep this market quiet in the short term, but once we get past that it is likely that we will continue to see people jumping into this index. The most recent low had found buyers at the 50-day EMA, much higher than the one before that had found support at the 11,000 handle. The market will continue to see more upward pressure, as we are clearly breaking out. It is possible that we could go even further than the 14,000 level, but that is my interim target for the time being. The candlestick for the trading session on Wednesday was a nice hammer, so this shows just how much resiliency there is. However, if we were to break down below this candlestick, it is likely that we could get a pull back all the way to 12,000. Regardless, I have no interest in trying to short this market, as it is far too strong.