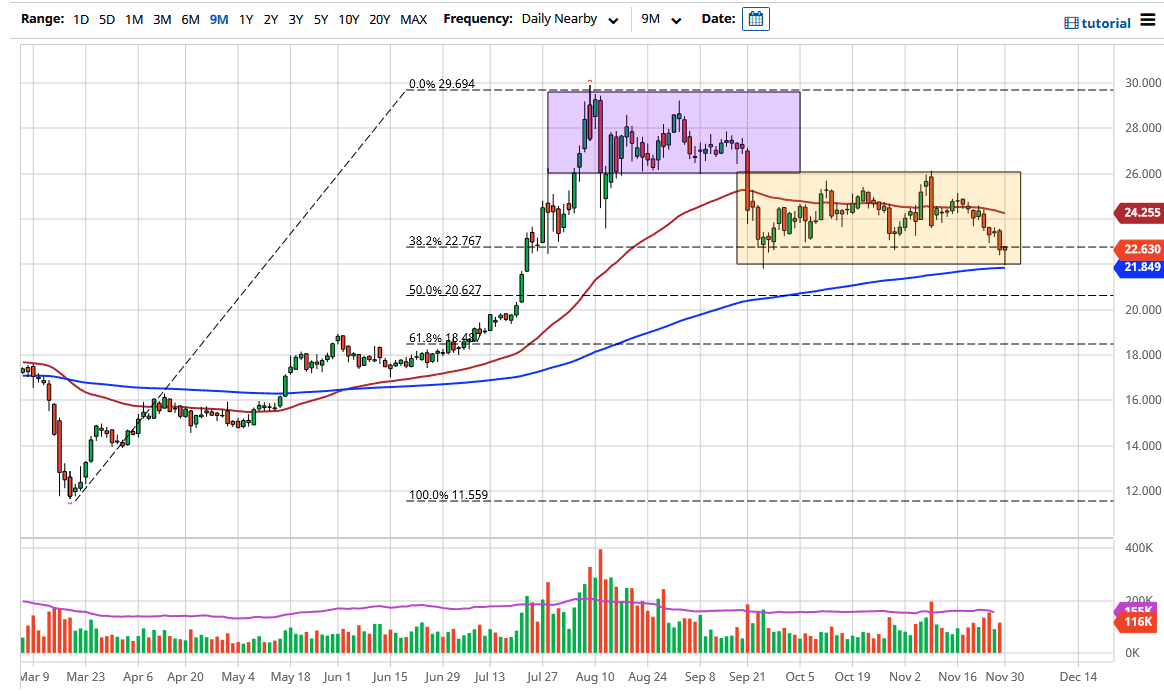

Silver markets fell during the trading session on Monday, reaching down towards the 200-day EMA yet again. Silver has fallen rather hard, but the fact that it bounced hard from the 200-day EMA does give buyers a glimmer of hope. It should be noted that the hammer is one of the more recognizable bullish signs, so I imagine that a certain amount of people are paying attention to it.

If we were to break above the top of the range for the Friday session, it is possible that traders will then jump into this market and try to aim for the 50-day EMA, which is sitting at the $24.25 level. It would then be likely that we would have a couple of days of bullish pressure ahead of us. This could be directly linked to the US dollar, which has a strong negative correlation to silver over the last 90 days or so. However, silver is part of the so-called “reflation trade”, so that comes down to easing from central banks as well. In other words, silver will get a huge boost, and I believe that it will be more or less a longer-term trend.

If we were to break down below the 200-day EMA, it opens up the possibility of a move down to the 200-day EMA underneath. That could have a lot of psychological and structural support built into it, but right now it is a stretch to assume that that can happen easily. After all, the candlestick for the Monday session is a perfect hammer, which suggests that buyers are probably going to become more aggressive. It will be interesting to see how the next couple of days play out, but at some point we will have to make a bigger move. We are sitting right at a crucial level on longer-term charts, so a lot of attention will be paid to the next couple of candlesticks. We have the jobs report later in the week, which almost certainly will suck the liquidity out of the market in the next few sessions.