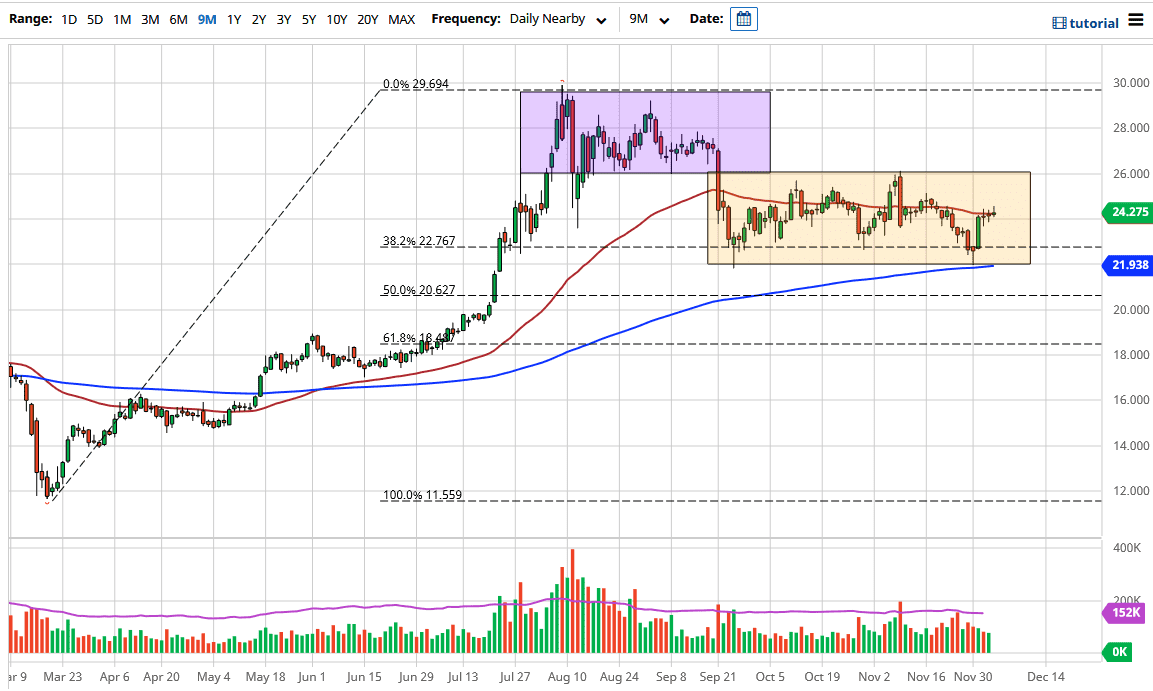

Silver markets initially tried to rally during the trading session on Friday, but gave back the gains to form a small shooting star. We are sitting at the 50-day EMA yet again, as we have been for the last three days. This is a market that is trying to digest the massive gains that we had from the Tuesday session. The market is looking a bit elevated, so it follows that we would go sideways for the time being. Eventually, silver should continue to go higher, and we may see a short-term pullback in order to find enough value to attract more buyers.

The $22 level underneath has offered a significant amount of support recently, which is an area that has been supported multiple times now. Furthermore, we have the 200-day EMA sitting just underneath that, so we will continue to see buyers in that area if we do pull back. Keep in mind that the US dollar is very influential as to where we go next and, with the dollar falling the way it has been, it is likely that we will continue to see the negative correlation going forward. So, I like the idea of buying pullbacks, but if we do not get one, you could consider buying a break above the highs on the Friday session. At that point, the market is likely to go looking towards the $26 level next.

This market is choppy and noisy but there is a longer-term uptrend that is very much intact, and the fact that we have gone sideways for some time suggests that we are trying to build up the necessary momentum to go to the upside. The $30 level above was the high from the surge several months ago, and I think we will go looking there. If we can break above it, then the market could really start to take off to the upside, but I believe that is probably more or less going to be an argument for next year. In the short term, I like the idea of buying value as it appears on these dips.