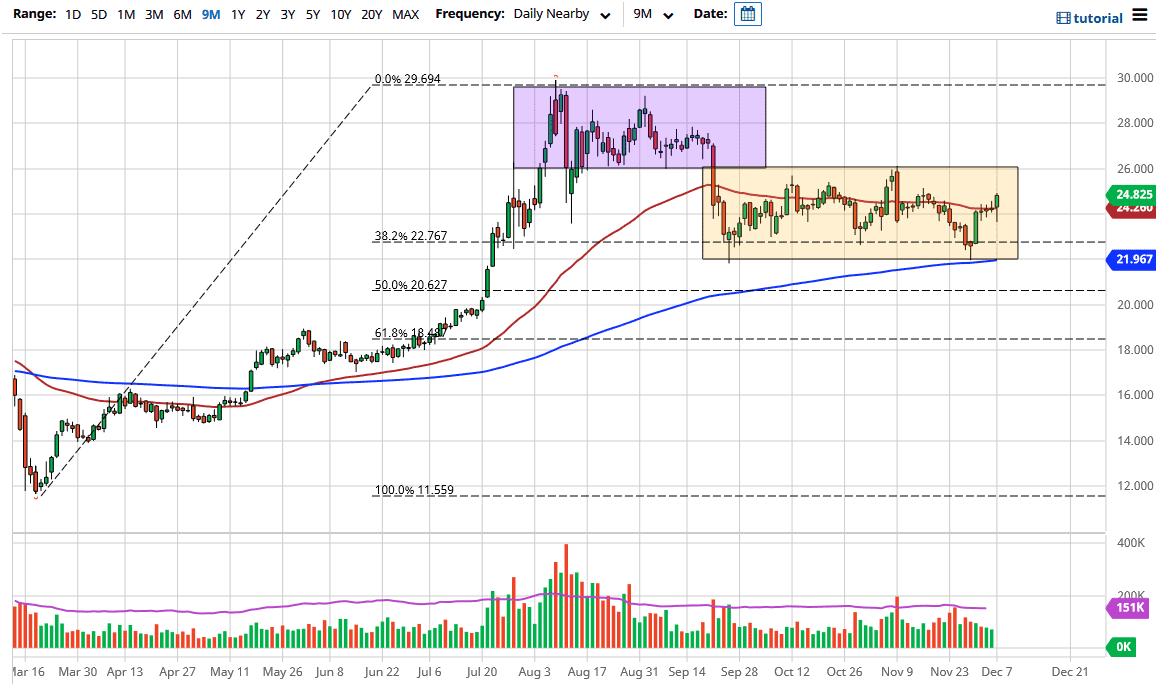

The silver markets initially pulled back during the trading session on Monday but found enough support below the $24 level to turn around and show signs of strength again. In fact, we ended up breaking well above the 50-day EMA and reaching towards the $25 level where we ran into just a touch of resistance. That resistance is psychological as well as structural, but it is obvious that people are starting to price in the need for a safety trade. While silver is a laggard when it comes to safety in comparison to its cousin gold, the reality is that it does tend to move in the same direction eventually.

Therefore, I am paying close attention to both of these markets and the US Dollar Index, which does have an inverse correlation, especially to silver. If that continues to fall, then it is likely that we will continue to see buyers jumping back into the silver market. The silver market attracts the “hard money” type of trader, but it also is priced in the same US dollars, so clearly that has an influence.

I do think that we will go looking towards the $26 level, perhaps even higher than that given enough time. If we can break above the $26 level, then it opens up the possibility of a move towards $27, possibly even $29 after that. The target is probably somewhere closer to $30. That is a large, round, psychologically significant figure that will attract a lot of attention and saw a lot of trading the last time we reached that level. If we were to break above there, silver would probably take off for a longer-term “buy-and-hold” type of move. At that point, we could be looking at a move towards the $50 level, but that would take some time. Nonetheless, I see no argument for shorting this market; it has been far too strong as of late, and the continued selling of the US dollar should be one of the biggest catalysts going forward.