Silver markets initially tried to rally during the trading session on Tuesday but found the $25 level to be a bit too much to get over. The market is likely to see a potential pullback but we have a lot of support underneath, so this probably comes down to the US dollar more than anything else. If you watch the US Dollar Index, it could give you a “heads up” as to where we might go. We will see that inverse correlation continue, and as we had some US dollar strength late in the session, it follows that the silver market would have pulled back.

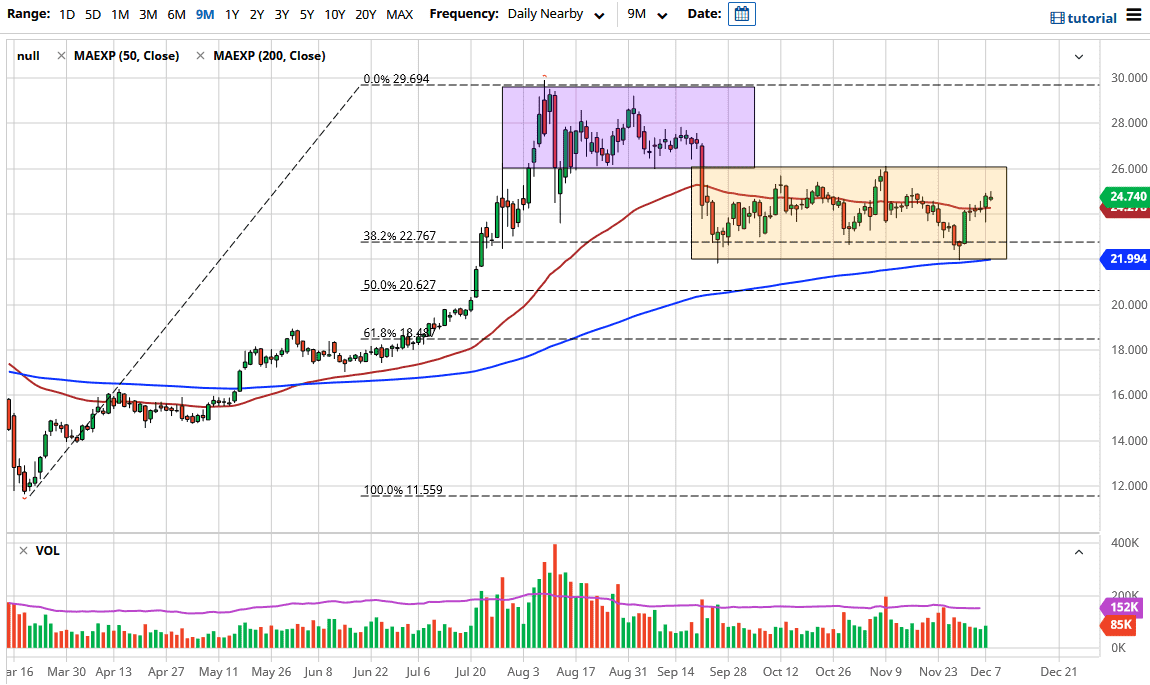

It is worth noting that we recently had broken above the 50-day EMA, and now it looks like we are trying to find plenty of buyers underneath. This pullback should be thought of as an opportunity to get long again, because silver has been so bullish for the last several days. In fact, when you look at the overall pattern going back to the beginning of September, we have been grinding sideways, perhaps digesting those massive gains from previous trading.

The candlestick from the previous session on Monday is one that I am most certainly paying close attention to, as it was such a massive reversal to confirm the three candlesticks before and the fact that they were trying to grind to the upside. Looking at this chart, the 200-day EMA sits at the $22 level, and I think it is very likely that we are going to see that offer a “floor” in the market. Value hunters will eventually come back in, so I have no interest in trying to short this market. To the upside, the $26 level would be an area to pay attention to as well, as it is the top of the consolidation that we have seen, but I do think we will break above there once the US dollar breaks 90 on the US Dollar Index. If it does not, then we may continue more choppy behavior.