The S&P 500 pulled back a bit during the trading session on Wednesday but turned around yet again. This is the way the market has been behaving for some time, as buyers will come in every time it sells off. This market is supported by massive amounts of liquidity, and the fact that government officials in the United States are starting to speak about stimulus again should continue to have people jumping into this market. But we have recently just broken out, so it would follow that we will digest the gains a little bit.

Furthermore, the market has to worry about the Non-Farm Payroll numbers coming out on Friday, so we could be a bit quiet or even lackluster on Thursday. A pullback makes the most sense, but even if we did rally, it will be relatively calm unless there is a stimulus agreement between Nancy Pelosi and Steve Mnuchin. Beyond that, it is difficult to see where we would get the momentum from, but that pullback will more than likely be a buying event down to the 3600 level.

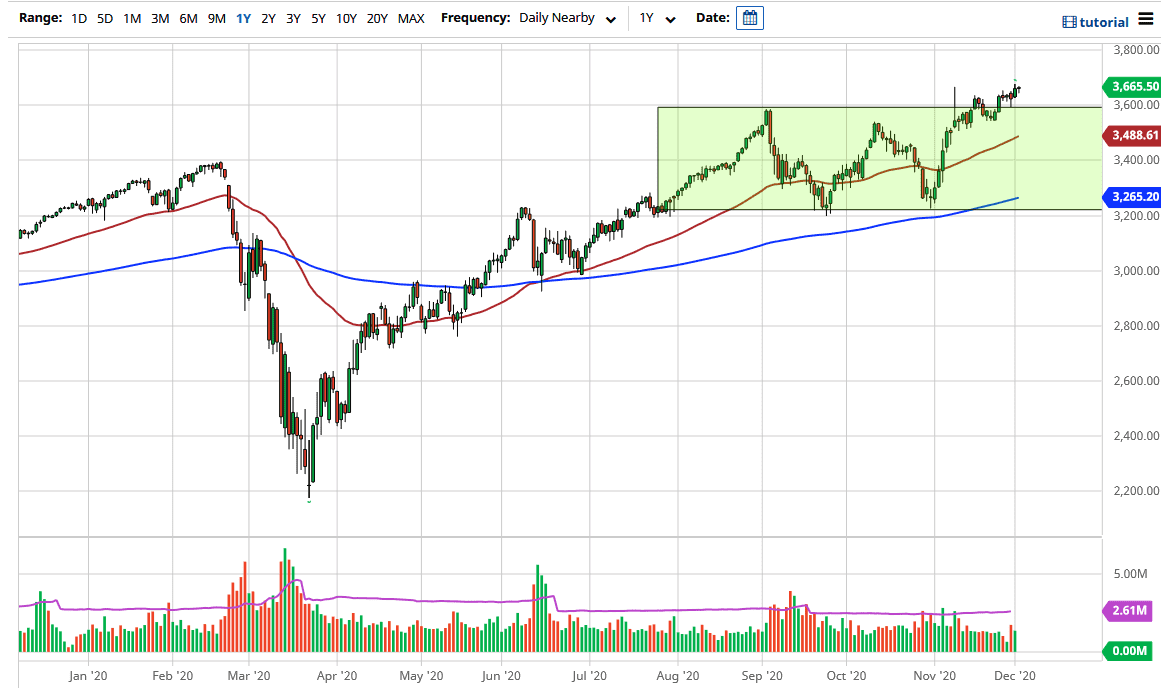

Furthermore, I think there is support down at the 3500 level as well, and possibly even as low as the 50-day EMA, which is near the 3488 handle. I like buying dips and I think that eventually we will get the opportunity to buy at lower prices. But we will likely explode to the upside due to the “Santa Claus rally” that seems to happen every year about this time. A lot of “padding of the portfolio” is done by money managers, so they have to buy stocks in order to show clients at the end of the year that they own certain names. We will continue to follow coronavirus vaccine headlines again, because that is without a doubt one of the most important longer-term market moving fundamentals. At this point, people are starting to price in the world after the pandemic.