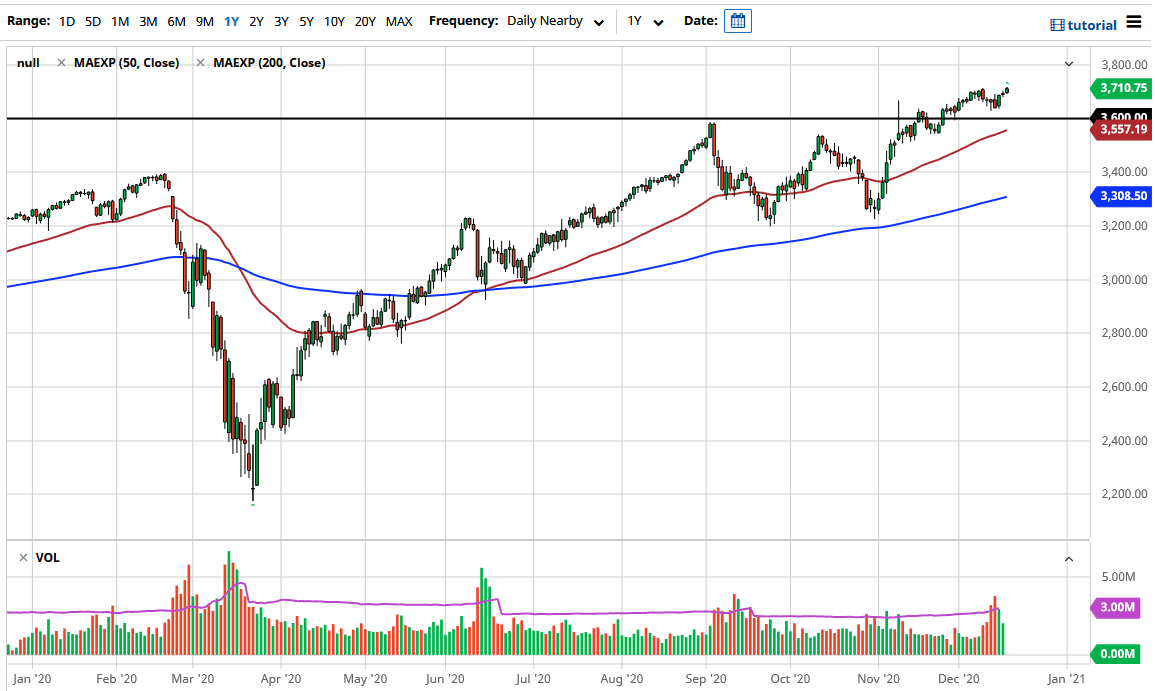

The S&P 500 has broken higher during the trading session on Thursday, reaching above the 3700 level. While this is very bullish, the question now is what comes next as we head towards quad witching? The biggest problem with quad witching, which is the expiration of four different types of options at the same time, is that it can cause massive amounts of volatility. As an example, during the last quad witching the NASDAQ absolutely cratered. However, at other times we have seen stock indices rallied quite significantly. Because of this, you need to be very cautious about putting too much on the table because although massive gains are nice, Murphy’s Law also dictates that if there is going to be a big move it is probably going to be against you.

This being said, I think that the 3600 level underneath offers plenty of support and I would be interested in trying to take advantage of a pullback in that general vicinity. I do believe that stimulus also has a major effect on the markets, and if they do announce something tomorrow or at least makes it seem as if a deal is all but imminent, that may skew the situation as well. With both stimulus talks and quad witching in the same session, this could be a real headache. If you have other things to do on Friday, you might be better off doing whatever that is.

If we were to break down below the 3600 level it could send this market lower, but even then, I would be looking for an opportunity to get long. There is a reason why “buy-and-hold” works, because over the longer term stock markets do rise. This being said, you are better off looking for value if you get the opportunity but if we were to break above the highs of the trading session you can also make an argument for simply grinding towards 3800. Longer-term, I believe that this market goes looking towards the 4000 level based upon the measured move of the recent consolidation area we have just broken out of. Because of this, I think what we are seeing here is a little bit of noise, just ahead of another leg up in the “Santa Claus rally” that tends to happen at the end of the year as portfolio managers try to pad their investments.