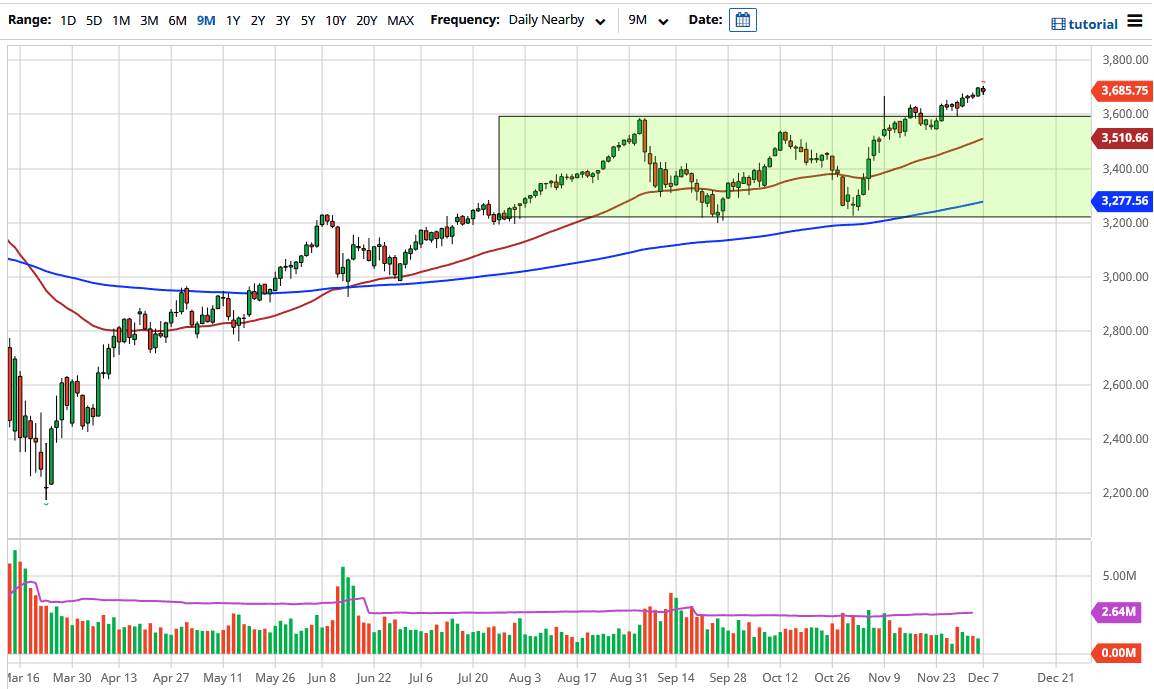

The S&P 500 fluctuated during the trading session on Monday to kick off the week in what has been a rather volatile situation. This is a market that will eventually find buyers on dips, so I look at the 3600 level underneath as massive support. Keep in mind that there are plenty of liquidity measures out there to continue to lift this market. Furthermore, people are starting to bank more on the recovery trade, as the idea of a coronavirus vaccine coming should open up the possibility of a move towards the new “normal.”

Looking at this chart, the 3600 level underneath should attract a certain amount of attention, but the 3500 level will be bullish as well, as the 50-day EMA is starting to reach towards that area also. You can see that we have broken above the massive resistance, and the market participants will continue to jump in and try to take advantage of this possibly massive uptrend. The market will probably extend out to the 4000 level based on the measured move, and I think many people will continue to look at this as an opportunity on dips.

The 50-day EMA has been crucial, but more importantly, we are looking at a significant uptrend and a barrier of support that extends from the 50-day EMA down to the 200-day EMA. I have no interest in shorting this market, due to the fact that the uptrend is so firmly ensconced and the Federal Reserve will jump into this market to support it, as Jerome Powell has been corrected by Wall Street multiple times when they did not get what they wanted.

It is worth noting that the most recent moves have been very back and forth in short ranges, and that will continue to be the case going forward. But the one thing that you should probably keep in mind is that we have the “Santa Claus rally” coming into the picture, as the money managers in the United States that have underperformed need to desperately own some of the same assets as everybody else, and it is likely that we will continue to see plenty of momentum over the longer term.