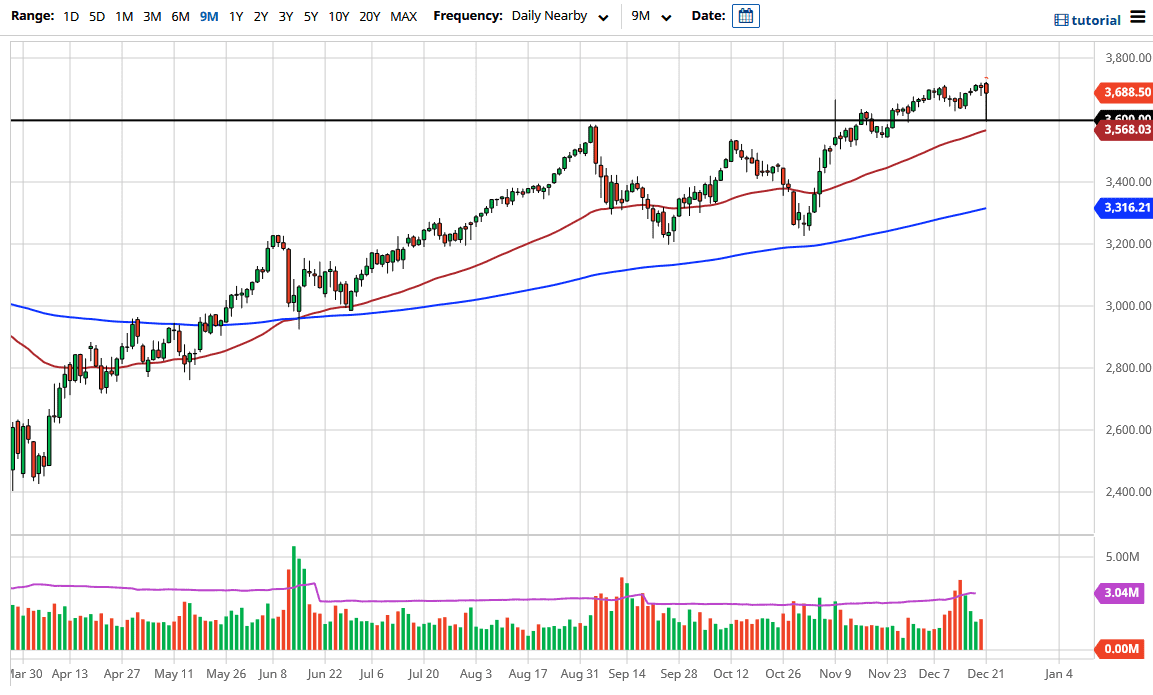

The S&P 500 broke down significantly during the trading session on Monday, due to concerns coming out of London about a mutated coronavirus strain. This had people very concerned and rushing towards the US dollar. This works against the value of stock markets in America, so do not be surprised at all to see this market pull back the way it has. However, we have also seen a nice bounce from the crucial 3600 level, an area that I thought should hold.

The shape of the candlestick is a strong hammer, and that suggests that there should be plenty of buyers in order to take advantage of these dips. Although it is holiday season trading, it is worth noting that we saw a complete turnaround. This is a market that will continue to see people looking at it as a “buy on the dips” situation. The 50-day EMA underneath should also offer quite a bit of support as well, so it looks like we are trying to go higher given enough time. I like the idea of buying these dips going forward, and I think most of the market participants do as well.

Keep in mind that it is the end of the year, which means liquidity is going to be a major issue, so keep your position size reasonable. I do not think that we are well served trying to jump in with big positions, but it is obvious to me as to what the direction is, and therefore, I think the market will probably go looking towards the 3800 level. Whether or not we get there between now and the end of the year is a completely different question, but it certainly looks as if we will try to get there. The 4000 level is the longer-term target, so the technical analysis I have been discussing for some time still holds. After all, we had been in a 400-point range previously, and have now not only broken out a bit but retested it for “market memory.” The market still looks very bullish, so we should continue to find reasons to go higher, not the least of which will be stimulus.