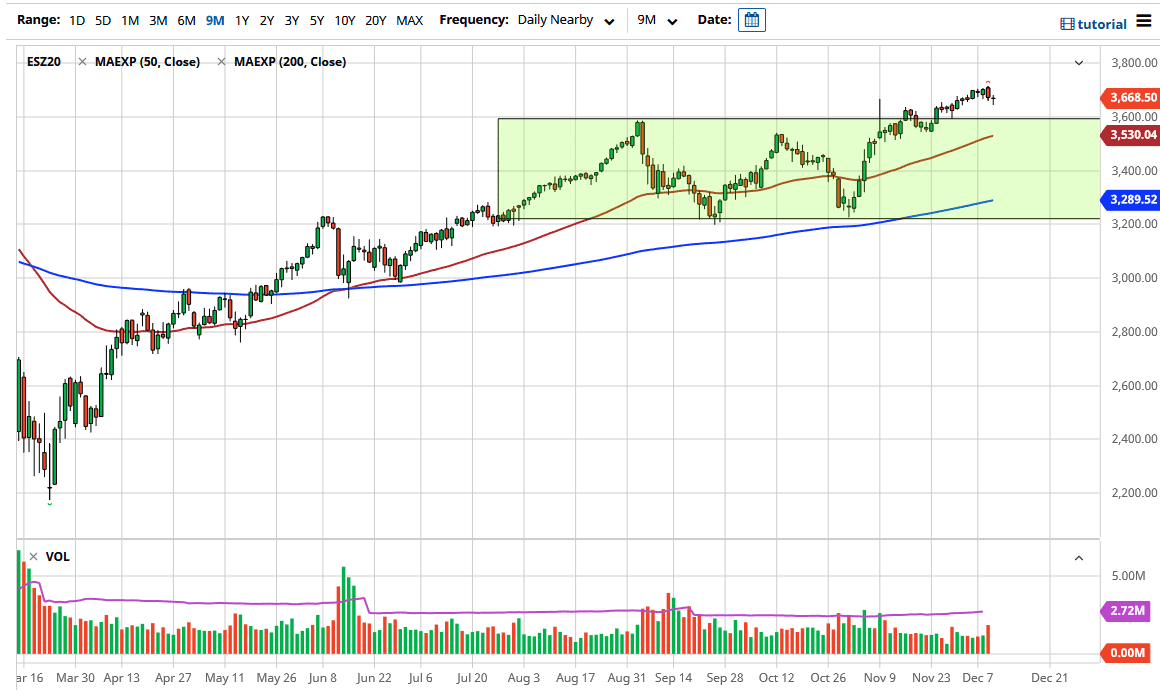

The S&P 500 fell during the trading session on Thursday but turned around to recoup most of the losses. At this point, the market is likely to continue to see buyers on dips, as we are still awaiting the “Santa Claus rally” to kick off in full bloom. We will probably see plenty of traders out there interested in picking up the market as it has been in such a strong uptrend, so people will be wanting to take advantage of the bigger move from which we have just broken out. After all, we had been consolidating for some time, and in a 400-point range. Over the last couple of weeks, we have broken out of there, and now I think we are ready to continue to go much higher.

The 50-day EMA is sitting at the 3530 level and offering support. The market is at a nice 45° angle, so a lot of momentum is still out there, and I do not think that the market is going to be exhausted. The 3600 level underneath should be massive support, which is a previous resistance barrier. We have even pulled back there to form a hammer last week, so it has already shown bits and pieces of strength. The market breaking above the top of the candlestick for the Thursday session suggests that we are going to go back towards the highs, and it is worth noting that people are likely to continue to buy due to the time of year.

If we can get some movement on the stimulus talks in the United States, that should continue to send this market to the upside. We will eventually get a breakthrough, and Wall Street will get the cheap money that it so desperately wants. Based upon the 400-point range from which we have just broken out, the “measured move” in the S&P 500 should be reaching towards the 4000 handle. This is not to say that we will get there overnight, and that is even a story that we will be talking about next year. Value hunting is probably the best thing that you can do, meaning that buying on the dips continues to work.