The S&P 500 initially pulled back during the trading session on Tuesday but then found buyers to send this market much higher, breaking above the 3700 level as we closed out the session. In the later hours, we saw the market wobble back and forth, but it is likely to continue to go higher and see a pullback that finds plenty of buyers. We are in the midst of the “Santa Claus rally”, so the stock markets will go higher.

Headlines and rumors about stimulus in the United States continue to push the markets around as well. Wall Street is looking for that next stimulus bill, which can send the market higher due to the fact that there is more “cheap money” out there to support the economy. Remember, Wall Street does not move on fundamentals so much anymore as it does on monetary policy and stimulus in general.

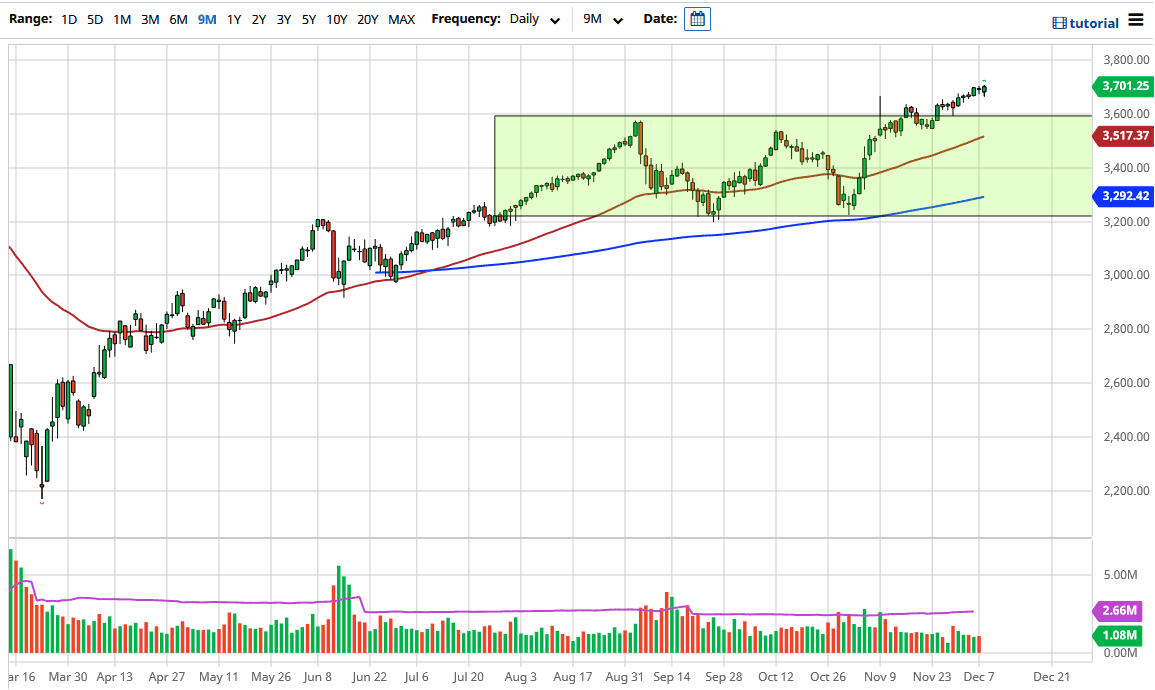

Looking at this chart, the 3600 level underneath should be a massive support level, as it was a major resistance barrier. Furthermore, even if the market goes down to the 3500 level, the 50-day EMA sits just above there, so either one of those areas could be of value to those looking to pick up a longer-term trade. Looking at the previous consolidation area, we had been in a 400-point range, and extrapolating that from the 3600 level has the target of 4000. Do not get me wrong, I believe that the market is likely to get to that level, but I do not expect it to happen in the short term. After all, that would be a rather big move. Between now and the end of the year I would anticipate bullish pressure, and then probably some pullback that goes looking for support. Any short-term support at this point will probably end up being a buying opportunity, unless we get a massive disappointment when it comes to the stimulus talks. It is hard to imagine that we will get something, so more than likely we will continue to grind.