The S&P 500 initially shot higher during the trading session on Monday but gave back the gains rather quickly as we see a lot of volatility and concerns as to whether or not stimulus will be a fact of life. The markets have been in an uptrend for some time, so it is not a huge surprise to suspect that there will likely be a certain amount of buying underneath. I like the idea of buying these dips, and we will probably see a reaction to stimulus if and when it comes. The biggest problem right nowa is the fact that we are talking about politicians, and there still so much at play in the United States when it comes to the Senate races in Georgia.

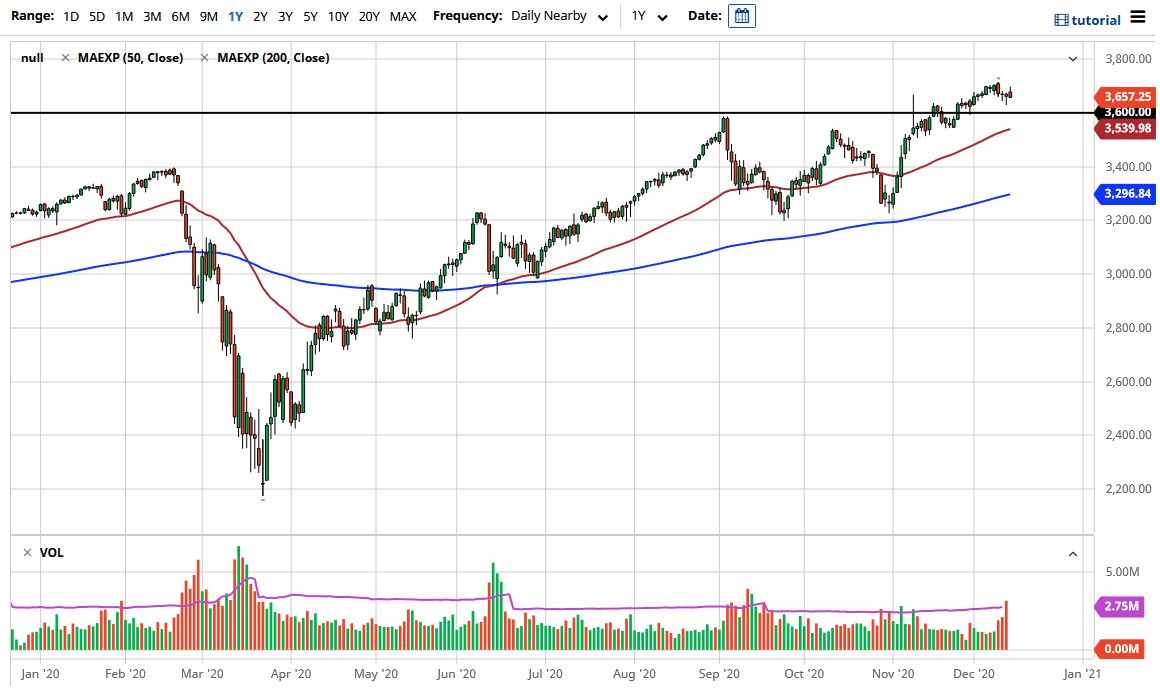

The 50-day EMA is currently sitting at 3539, just below the crucial 3600 level. The 3600 level is a large, round, psychologically important figure that many people pay attention to, and it did signify a decent breakout. It is because of this that downward momentum is somewhat limited, unless we do not get any stimulus at all. If that fails to materialize, traders will throw a tantrum in order to get the Federal Reserve or Congress to act. The markets have been trained that if they make enough noise, people will come to protect them.

To the upside, the 3700 level is obvious resistance and, if we can break above there, it is possible that we could go looking towards the 3800 level. After that, we would be talking about a move to the 4000 level, which is what I believe is the final destination based upon the recent rectangle from which we have broken out, and the fact that it was 400 points. You are best served buying dips in a market that is in an obvious uptrend, so there is no reason to overthink things. Look for supportive candlesticks underneath, or a bounce from either the 3600 level or perhaps even the 50-day EMA in order to start buying again. That is exactly how I am playing the S&P 500.