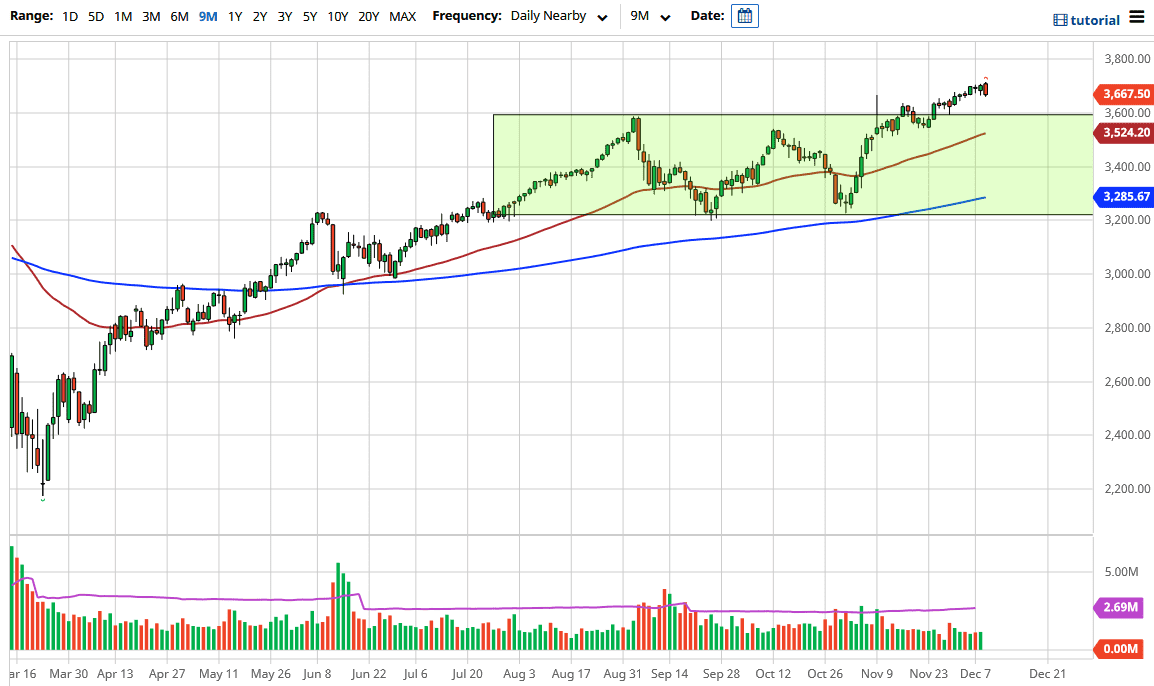

The S&P 500 fell significantly during the trading session in order to wipe out the last couple of sessions, but at the end of the day we are still very much in an uptrend. While we did close off the bottom of the candlestick, a lot of this is based on stimulus and the negotiations between McConnell and Pelosi. In the short term, I think that we will probably see more negativity in the market, but given enough time, buyers will jump back in.

Underneath at the 3600 level, there should be a significant amount of support - not only because it is a large, round, psychologically significant figure, but it is also the scene from which we broke out. Furthermore, the 50-day EMA is crossing the 3525 handle, which should continue to reach towards that 3600 level as well. Somewhere between here and the 50-day EMA we should see buyers on the first signs of a significant bounce. This will be especially true if we have a certain amount of good news coming out of the stimulus situation that could send the S&P 500 right back up. This is a market that will eventually see reasons to go higher, so look at this as a potential buying opportunity in a marketplace that is clearly in a strong trend.

Based on the measured move of the previous consolidation area, I am still calling for the market to go looking towards the 4000 handle, but that is going to take some time, perhaps during the middle of next year. In the meantime, look at these pullbacks as giving the market the ability to build up the necessary traction to go higher. After all, you cannot simply go straight up in the air. I have no interest in selling this market - it is far too strong - and it is at a nice angle of trajectory at the moment, something that is nice and steady and easily sustained instead of parabolic like we have seen at times.