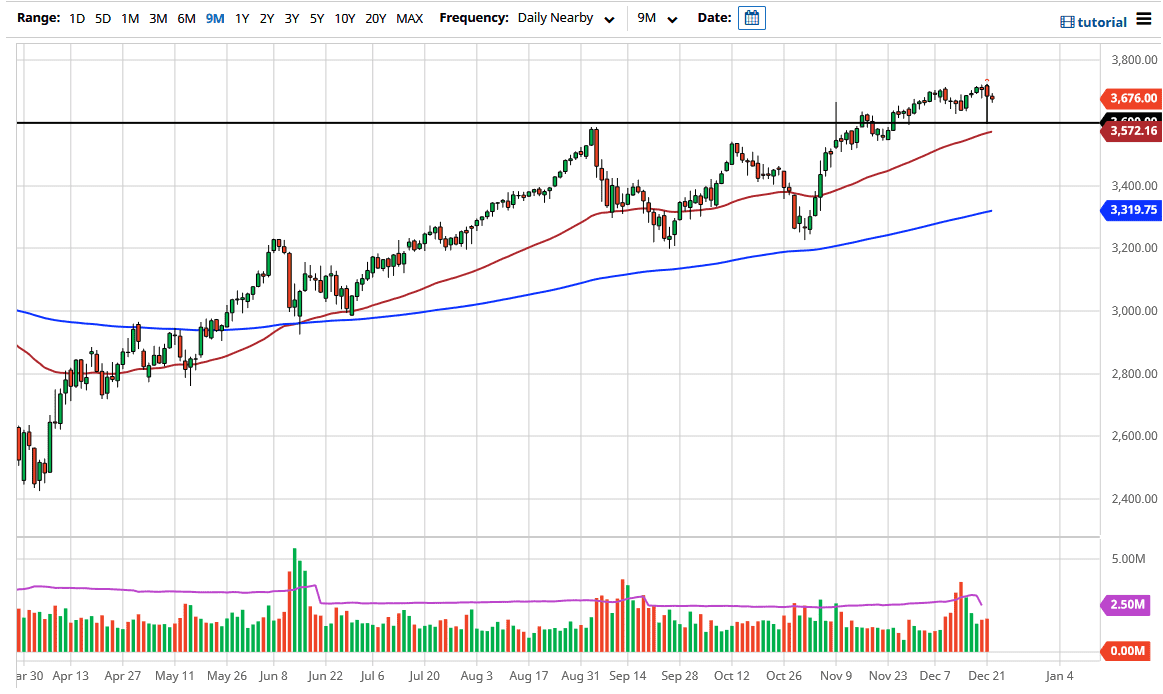

The S&P 500 has done very little during the trading session on Tuesday as we continue to see the markets focus on the holidays. The 3600 level underneath should be supportive, as it is a large, round, psychologically significant figure and is the top of the recent consolidation in which we had been. That consolidation area measured 400 points, which suggests that now that we are out of it, we could go looking towards the 4000 handle.

What is even more interesting is that the 50-day EMA sits just below the 3600 handle, so it is only a matter of time before the buyers would come back into this market near that 3600 level. The slope of the 50-day EMA is very bullish as well, which will continue to attract buyers. To the upside, the market probably sees the 3600 level as an initial target, followed by the 3800 level.

Even if we were to break down below the 50-day EMA, there are plenty of buyers underneath to take advantage as the S&P 500 is based more or less on the idea of liquidity. It is the end of the year, which has a major influence on the idea of liquidity. The lack of liquidity could make significant moves likely, but at the end of the day, once liquidity picks back up the buyers will return.

As long as central banks and governments around the world continue to throw money at issues, we will see stocks go higher. It is a bit of a self-fulfilling cycle, something that we have seen since the Great Financial Crisis, and there is no real way to see this ending anytime soon. It makes perfect sense that traders will continue to see noisy behavior, but overall, it is a market that only has one direction from a longer-term standpoint. If you can keep your position size relatively small you will be able to ride through all of the noise, but eventually take advantage of the longer-term proclivity and trend to which the S&P 500 is prone.