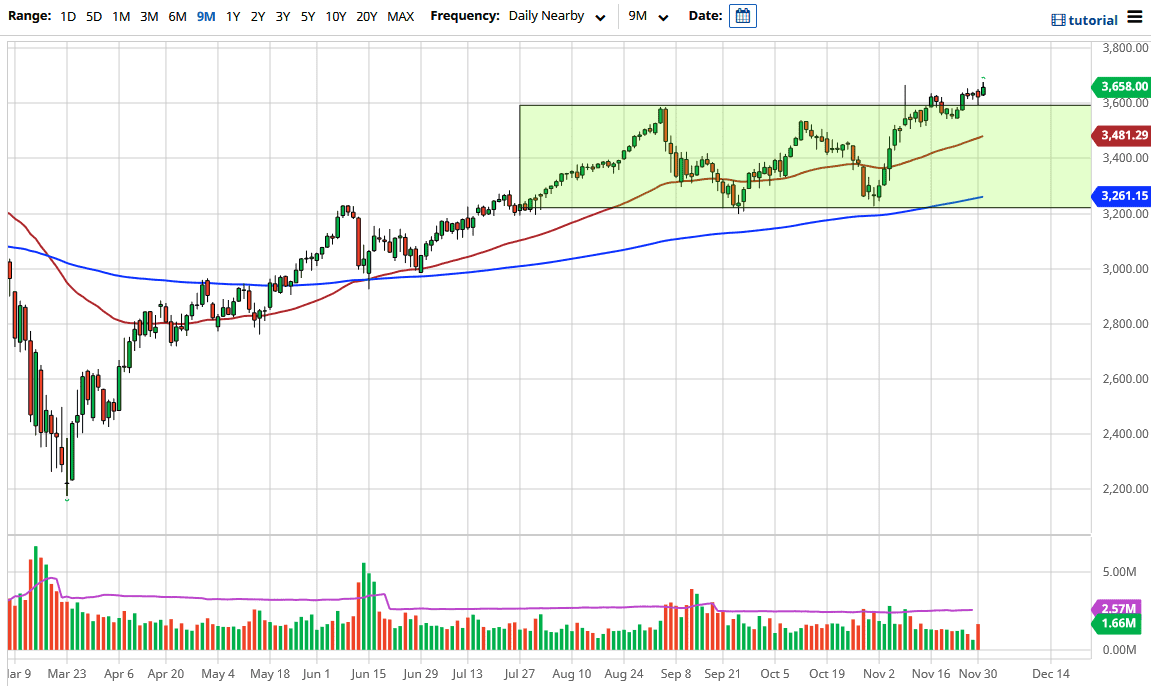

The S&P 500 had an explosive session during the trading day on Tuesday as it continues to press all-time highs. In fact, it even broke above the all-time high, but pulled back ever so slightly at the end of the day. Nonetheless, with talks about stimulus coming out of the United States, it does suggest that we will eventually have enough of that “cheap money” that sends stocks flying. Many people probably got shaken out during the day on Monday as there was a lot of rebalancing going on. However, this is an uptrend that has finally broken out, and now that we have a 400-point range behind us, it should open up the possibility of a move all the way to the 4000 handle, which is my target.

I have no interest in shorting the S&P 500, because Wall Street will be celebrating the coming stimulus. Coronavirus vaccines are also coming in a bit, and that will have people looking towards the “recovery trade.” The market continues to find value hunters every time it dips, and it is difficult to find a scenario in which you would suddenly become a seller, as fighting that type of trend would be dangerous, to say the least.

This is not to say that I would throw my entire portfolio at the S&P 500. Rather, every time we pull back it is a buying opportunity, so you can build up a bigger position. We are about to get the “Santa Claus rally”, which will show itself by the end of the year as a lot of money managers out there will be looking to add stocks to their portfolio for window dressing. They need to be able to tell their clients that they are owners of some of the biggest companies out there, and also the latest winners. This is something that is a well-known phenomenon, so whether or not it is true does not really matter at this point. What matters is that most people believe it. Between that and the possibility of a Republican Congress, this sets up quite nicely. The dollar getting broken during the trading session helps drastically as well.