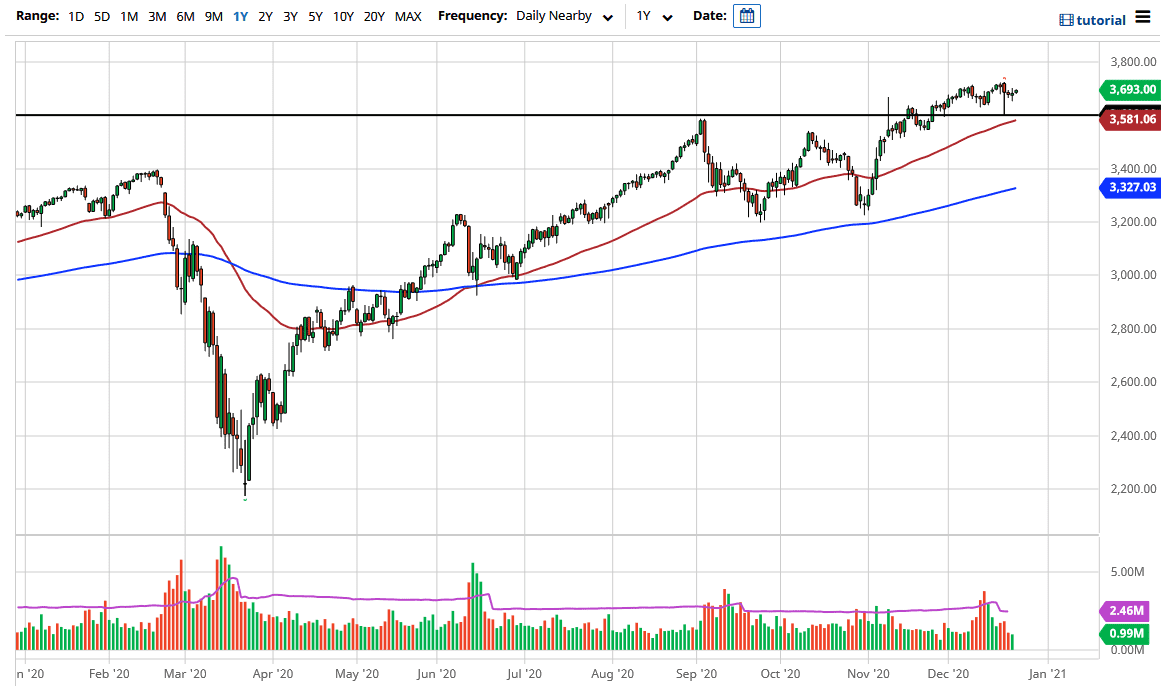

The S&P 500 did very little during the trading session on Thursday, but that is not a huge surprise. After all, most traders are not going to be worried about trading the day before Christmas. We are very bullish-looking, and the last couple of weeks have been a simple sideways market between the 3600 level and the 3700 level. Because of this, it makes sense that the market continues to do more of the same simply to digest some of the massive gains that we have made.

The market has recently seen a consolidation area between the 3200 level on the bottom and the 3600 level on the top. That measures for a 400-point move, and if it were any other time of year, I would not be surprised at all to see this market go higher. However, as we reach into the holidays, it is not a huge surprise to see that traders may have been a bit hesitant to throw a ton of money into the market. Looking from a technical analysis standpoint, the market is likely to go looking towards the 4000 level above, based upon the measured move.

I would expect a lot of noise between here and 4000, but eventually we should get there. Stimulus will make sure it happens if for no other reason, but we also have a rotational trade going on right now where people are getting away from the “stay-at-home stocks” and starting to look at value stocks. That will help lift the S&P 500 as well, due to the fact that there are so many companies that will lift it. At this point, stocks look very good for the first quarter of next year, because traders are starting to focus on the longer-term aspect of a vaccine for the coronavirus, and the eventual “re-opening trade.” This will take a while to actually play out, so there will probably be a lot of money flowing into the market, and that is going to be more or less a cyclical trade that people will get involved in. To the downside, the 50-day EMA sits just below the 3600 level as well. I do not have any interest in trying to short this market.