The S&P 500 rallied rather significantly during the trading session on Friday. It wasn't the biggest move, but we closed at the top of the candlestick for the day after the non-farm payroll numbers were announced and at all-time highs. The market looks very likely to continue going higher.

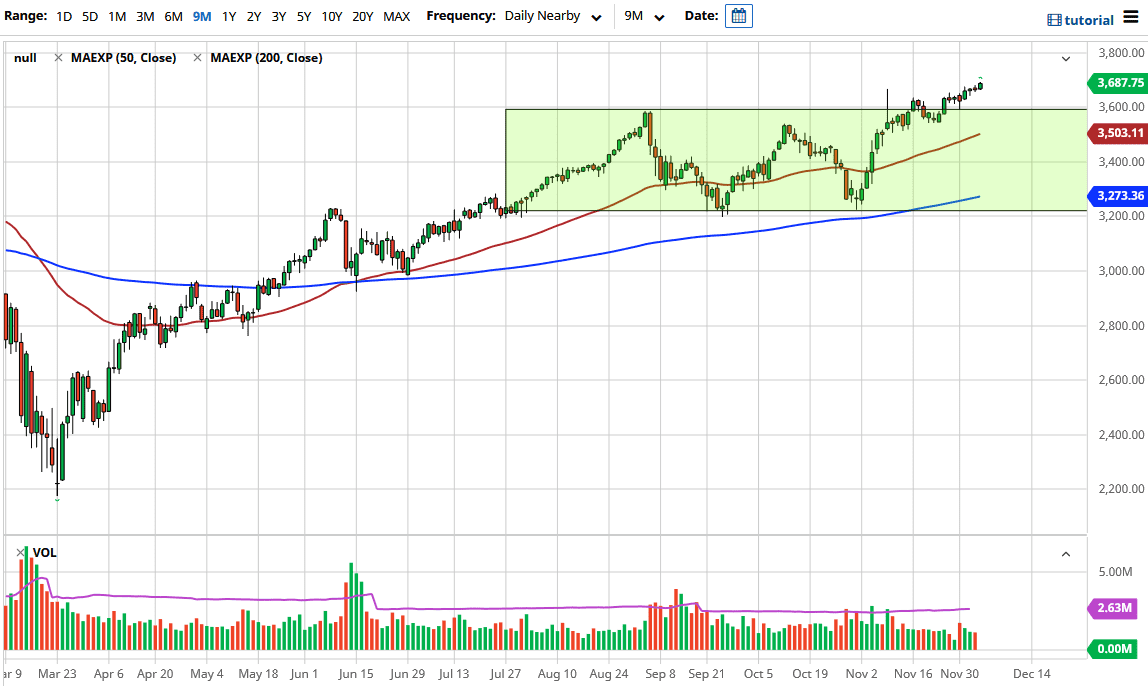

This is a market that has broken out of a significant consolidation area underneath, so you need to take the measured move as far as your strategic implementation of a trading plan. Looking at the green rectangle that I have plotted on the chart, you can see that it was 400 points. At the breakout point of roughly the 3600 level suggests that we could go all the way to the 4000 handle. The 4000 handle is psychologically important, so it will have a certain amount of influence and profit-taking attached to it. But that is probably something we will see later on in 2021.

As Nancy Pelosi and Steve Mnuchin are continuing talks about stimulus, a lot of traders are banking on the idea of more of that “easy money” coming into the stock market, so people will remain bullish. It is very likely that pullbacks will continue to be bought into, unless we get a deterioration when it comes to stimulus talks. At this point though, it looks likely that we will see something come out of Congress as we continue to hear more conversations. However, it is difficult to imagine that it is going to be a massive stimulus, at least not as big as the Democrats wanted. After all, we still have a very important runoff election for senatorial seats in Georgia, so there is still very much at play in the meantime.

Regardless, this is a market that has been in an uptrend forever. So, I like buying pullbacks and I believe the 3600 level is going to be your short-term floor, with the 50-day EMA at the 3500 level being a longer-term floor for what should be a continuation of what has been such a strong move. It is worth noting that the volatility has shrank quite a bit, and that should allow for more sustainable bullish pressure.