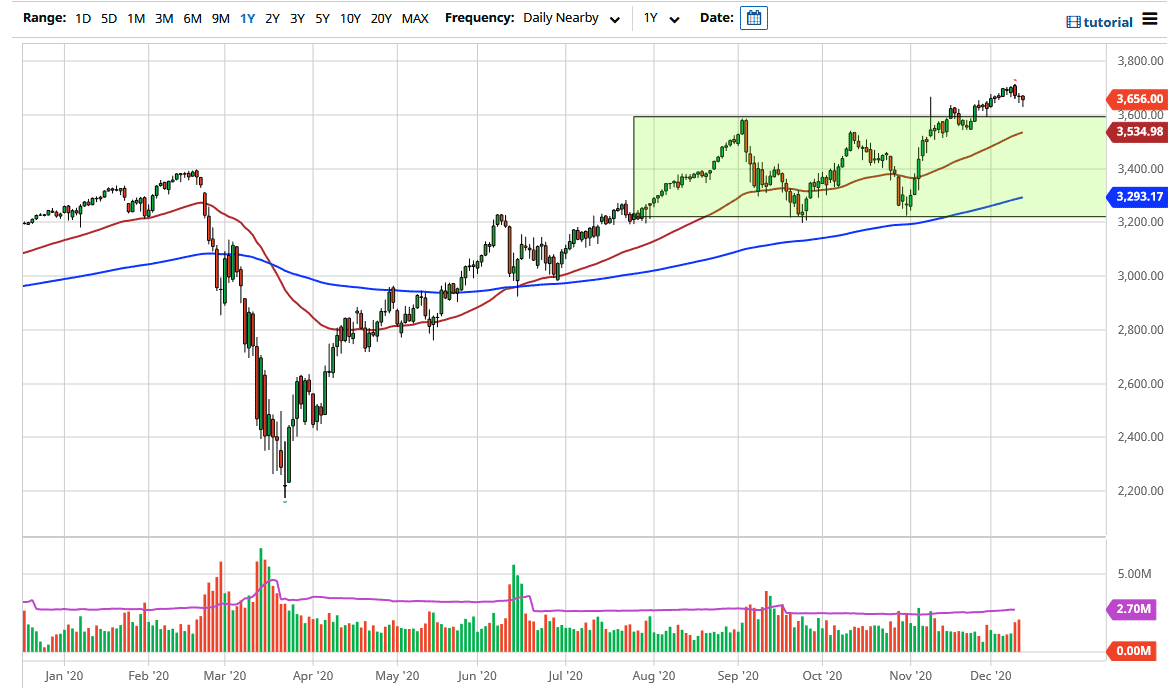

The S&P 500 initially fell during most of the trading session on Friday, but as the rest of the world left the trading to the Americans on their own, they started buying up everything and turned things around to form a hammer. Remember, typically during this time a year we do see buyers coming back into the marketplace, trying to pad results for the year. This is the so-called “Santa Claus rally”. Furthermore, many people are trying to “front run” the stimulus talks, assuming that there is in fact going to be an agreement. If that is the case, then Wall Street will get what it wants, and we will continue to go higher.

To the downside, I see the 3600 level as being rather supportive. I anticipate many buyers coming back into this market somewhere near that area. Even below there, we could see significant support down at the 50-day EMA which is painted in red on the chart. We are continuing to see value hunters come back into the marketplace, and they are probably trying to “front run” the stimulus announcement, as mentioned.

To the upside, I see the 4000 level as the longer-term target based on the measured move in the consolidation area underneath from which the market just broke out. Between now and then, I see multiple areas of interest, but the initial one would be the 3700 level, possibly even the 3800 level. As we continue to head into the Christmas season, people will be looking to buy all the major stocks out there that have grabbed the headlines so that clients feel they are putting money to work. This is a yearly phenomenon that almost works like clockwork, so there is no need to fight this move. However, if we do not get positive movement in the stimulus situation, we could get a bit more of a pullback on Monday, but that should only end up being a nice buying opportunity.