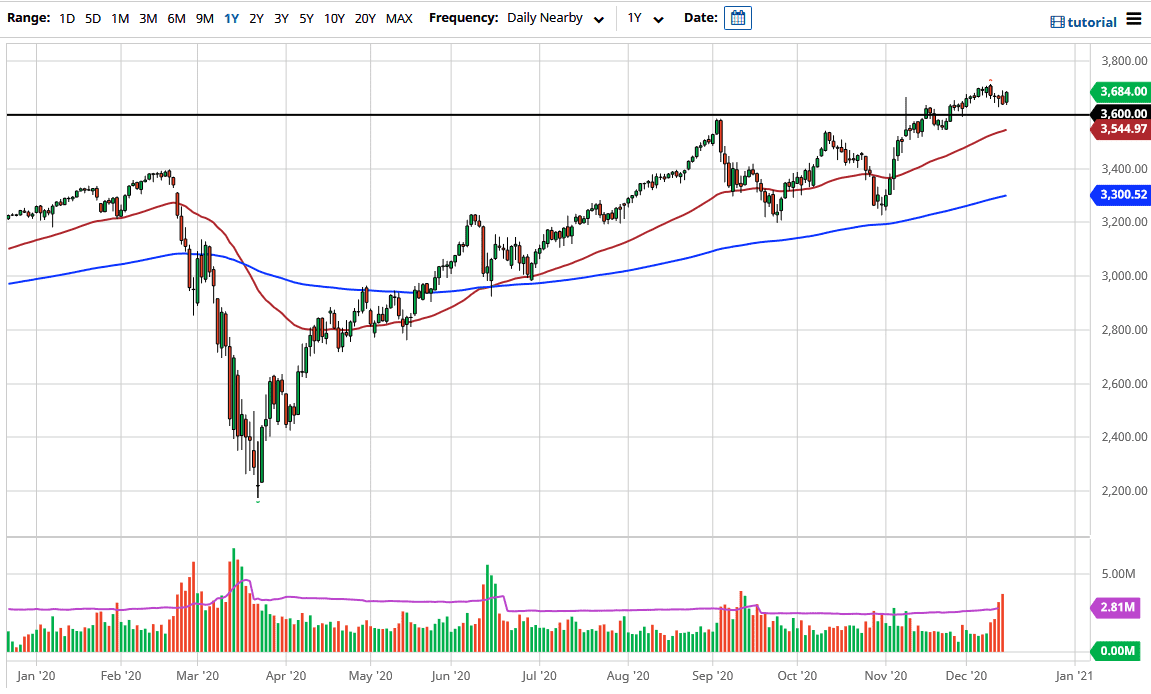

The S&P 500 rallied significantly during the trading session on Tuesday as we await the Federal Reserve announcement on Wednesday. This is a market that will continue to go higher based on hopes of stimulus. The 3600 level underneath should be massive support, just as the 50-day EMA underneath will continue to go higher as well, which should offer dynamic support. The market will go looking towards the 3700 level, which is a large, round, psychologically significant figure, and in the short term it is likely that we would target that. But if we break out above there, the market may continue to go higher, perhaps reaching towards the 3800 level.

To the downside, I see so many areas that could offer support, and it is only a matter of time before the Federal Reserve does something to boost the economy. In that event, we would see buyers jumping in to pick up the S&P 500 as we move out on the risk curve. People will also take advantage of the fact that the Santa Claus rally is most certainly here, although we do have to worry about “quadruple witching” sometime this week. The actual event of four different options markets expiring at the same time is Friday, but sometime this week you will probably see people trying to dump stock in order to get away from the trouble. However, the volatility will get out of its way and we should continue to see a move to the upside.

The Federal Reserve will have a major influence on what happens next, and they will likely do whatever they can to support markets. After all, Jerome Powell has shown time and time again that he will do whatever it takes to keep Wall Street happy, and help stock markets go higher. Congress also has stimulus coming out sooner or later, which could affect the market going higher as well. This is a market that I have no interest whatsoever in shorting.