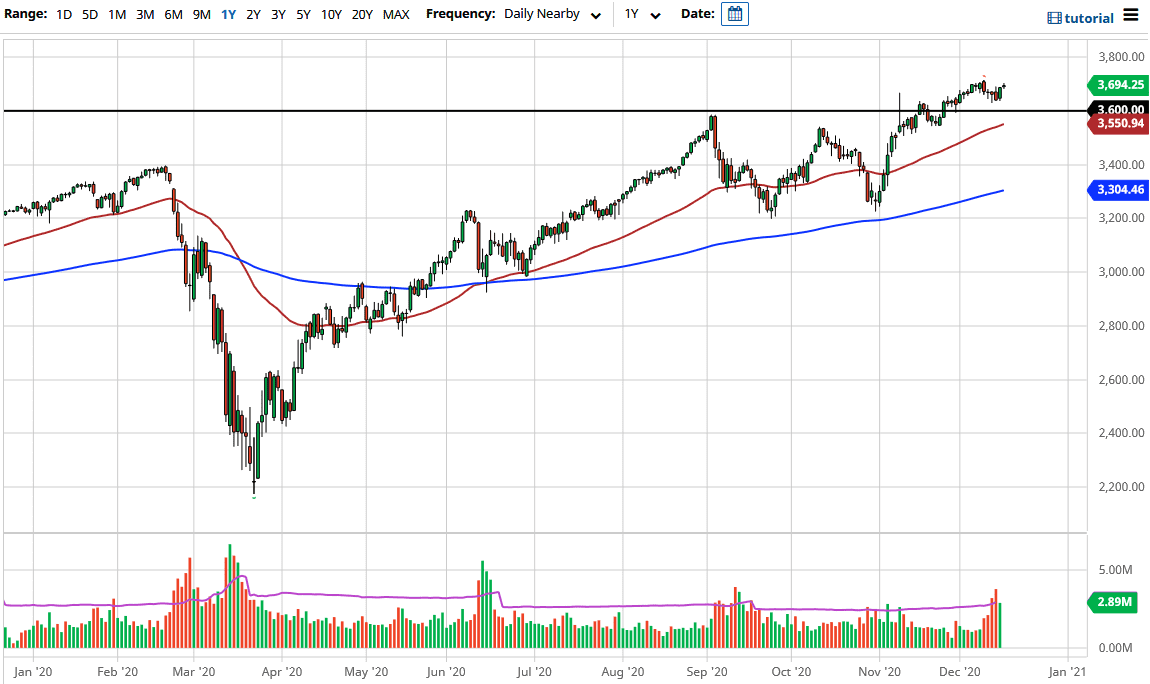

The S&P 500 fluctuated during the trading session on Wednesday as the 3700 level offered a bit of resistance. The market looks as if it is trying to form an ugly flag, and that suggests that we are going higher. Once we finally get the stimulus out there, I suspect that Wall Street will continue to push the markets higher due to the “Santa Claus rally”. There is no other alternative at this point, seeing as there is not much in the way of yields when it comes to bonds.

Pullbacks should continue to show plenty of support down to the 3600 level. The candlestick from the trading session on Tuesday is something worth paying attention to because it wiped out a significant amount of selling pressure from the previous session. This market will go towards the 3800 level once we clear the 3700 level on a daily close. Underneath, we had been consolidating in a 400-point range, which extrapolates to a move towards the 4000 level, which is my longer-term target. That will happen sometime next year, so we will continue to see plenty of buyers.

The 50-day EMA sits at the 3550 handle, which is just below the 36 level. Therefore, I think there will be a bit of a “double whammy” when it comes to support in this market, so I like the idea of buying these dips even more because of that. I have no scenario in which I'm willing to short this market, because nobody else is doing so. This is one of those scenarios in which you do not try to overthink the entire situation, as most people will be trying to get too cute with this market. Therefore, we are looking at an opportunity to pick up the market every time it gets cheap, which by today’s standards simply means every time it pulls back. Unless there is no stimulus, I just do not see a scenario in which you would want to be short of the S&P 500 anytime soon.