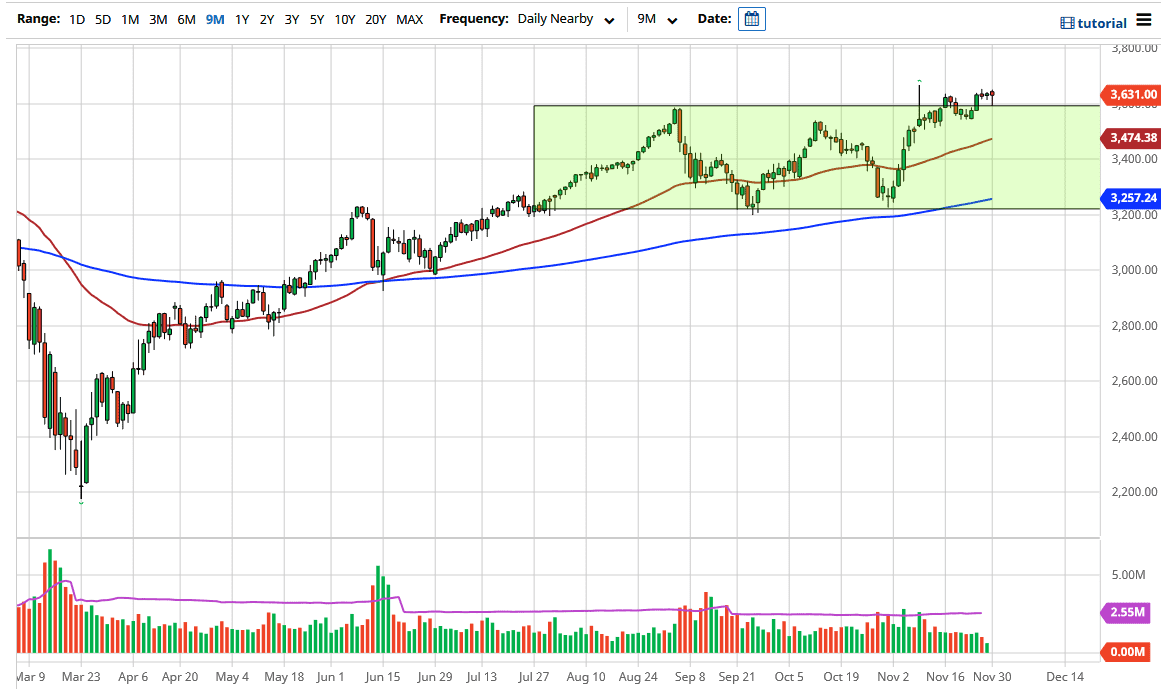

The S&P 500 initially fell during the trading session on Monday, then sold off as we did the end of month rebalance and reached towards the crucial 3600 support level. We turned around to form a nice-looking hammer, which suggests that the market is ready to continue going higher. At this point, buying the dips seems to be the best method going forward, as it has been for some time and now. We may see a continuation of the way this market has been moving for some time. It is a simple matter of following what has been the case for most traders, simply taking advantage of that “cheap money” that Wall Street loves.

To the downside, the 50-day EMA is sitting at the 3475 handle, and I think that will be support as well, assuming that we break down below the 3500 level. From a longer-term standpoint,we will go looking towards the 4000 level, based on the consolidation area that we had been in previously at 400 points. The market will get to the 4000 level, simply because you cannot short the S&P 500 anytime soon. After all, it is not an equal-weighted index, so don't try to fight what everybody else is buying. With that in mind, I look at dips as buying opportunities and never as selling opportunities. Even if there is a massive selloff, you can see how it has been bought every time that has happened over the last 13 years or so. There is no point in fighting the market; it goes up over time and sooner or later people get involved and start buying. It is simply the way Wall Street continues to work. This does not mean that you always have to be long, but certainly being short is going to be very dangerous under most circumstances. In fact, any time I see a massive selloff, I tend to play that using puts.