The US dollar initially spiked against the Brazilian real on Monday, as the markets were very thin due to holiday trading. You can only read so much into some of the price action, but one thing is obvious: the US dollar got a boost. This was not anything to do with the Brazilian real, because the US dollar was gaining against almost everything. This was kicked off as traders do not trust the British pound, and looked for the safety of the US dollar with the lockdown of the United Kingdom amid fears of a mutated coronavirus outbreak. The British pound was sold drastically, but this had a bit of a “knock on effect” in multiple pairs.

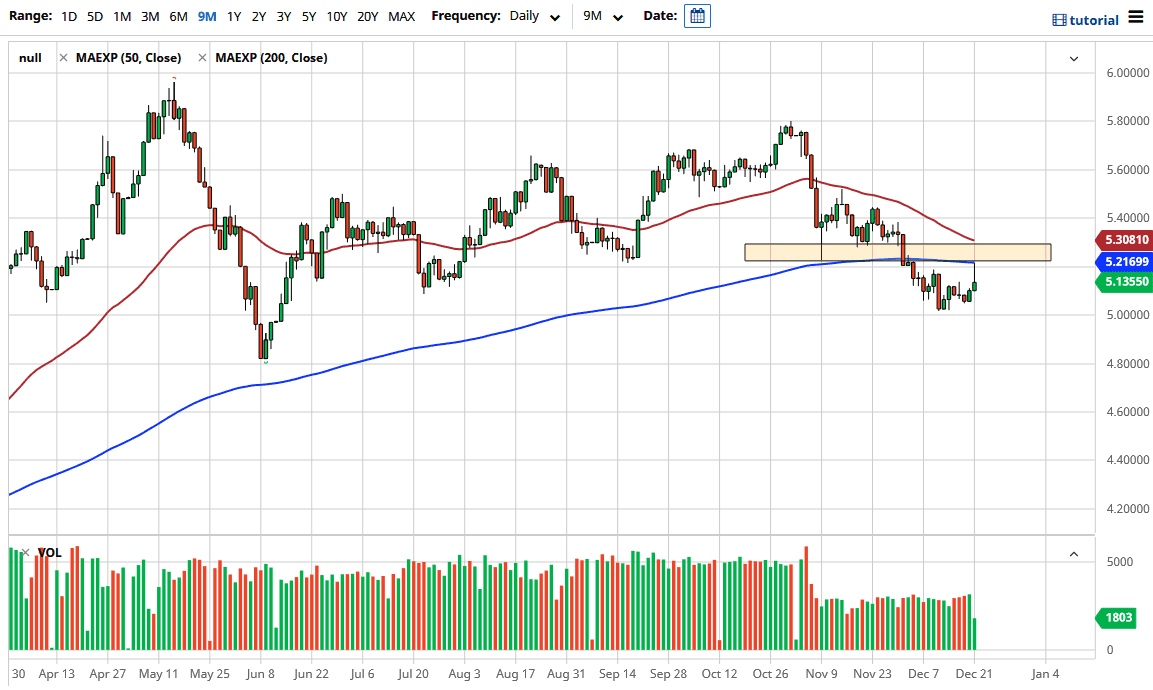

One of the biggest concerns that will influence the Brazilian real is that Brazil has struggled with a high coronavirus infection rate. However, by the end of the day, we did see the US dollar give back quite a bit of the gains, and at a technically important level. You can see that the blue moving average, which is the 200-day EMA, has offered significant resistance at the 5.21 level. In fact, we ended up forming a shooting star, which suggests to me that most of the move was probably exaggerated due to the lack of liquidity during the holiday week. It will be very tough to trade emerging market currencies, but clearly the US dollar has been in a downtrend.

When training emerging market currencies such as the Brazilian real, you need to think more about trend trading and trading it as an investment. It is clear that we are getting ready to continue going lower based upon what we have seen so far, and it is also possible that we may be seeing the so-called “death cross” as the 50-day EMA is starting to race towards the 200-day EMA and getting ready to cross below it. At this point, I still believe in shorting this pair on rallies, just as traders did on Monday. Granted, the next couple of sessions will probably be very messy, but it does look as if we are going to continue to threaten the 5 BRL level underneath.