With India on course to breach 10,000,000 COVID-19 cases before the end of 2020, and after it entered its first recession since record-keeping began, S&P Global Ratings confirmed its 9.0% GDP contraction forecast for the 2020-2021 fiscal year. The rating agency noted developing upside potential, but added that it remains premature to adjust the outlook. For the fiscal year 2021-2022, S&P Global Ratings predicts a 10.0% GDP expansion. Following the breakdown in the USD/INR, a more massive correction can materialize.

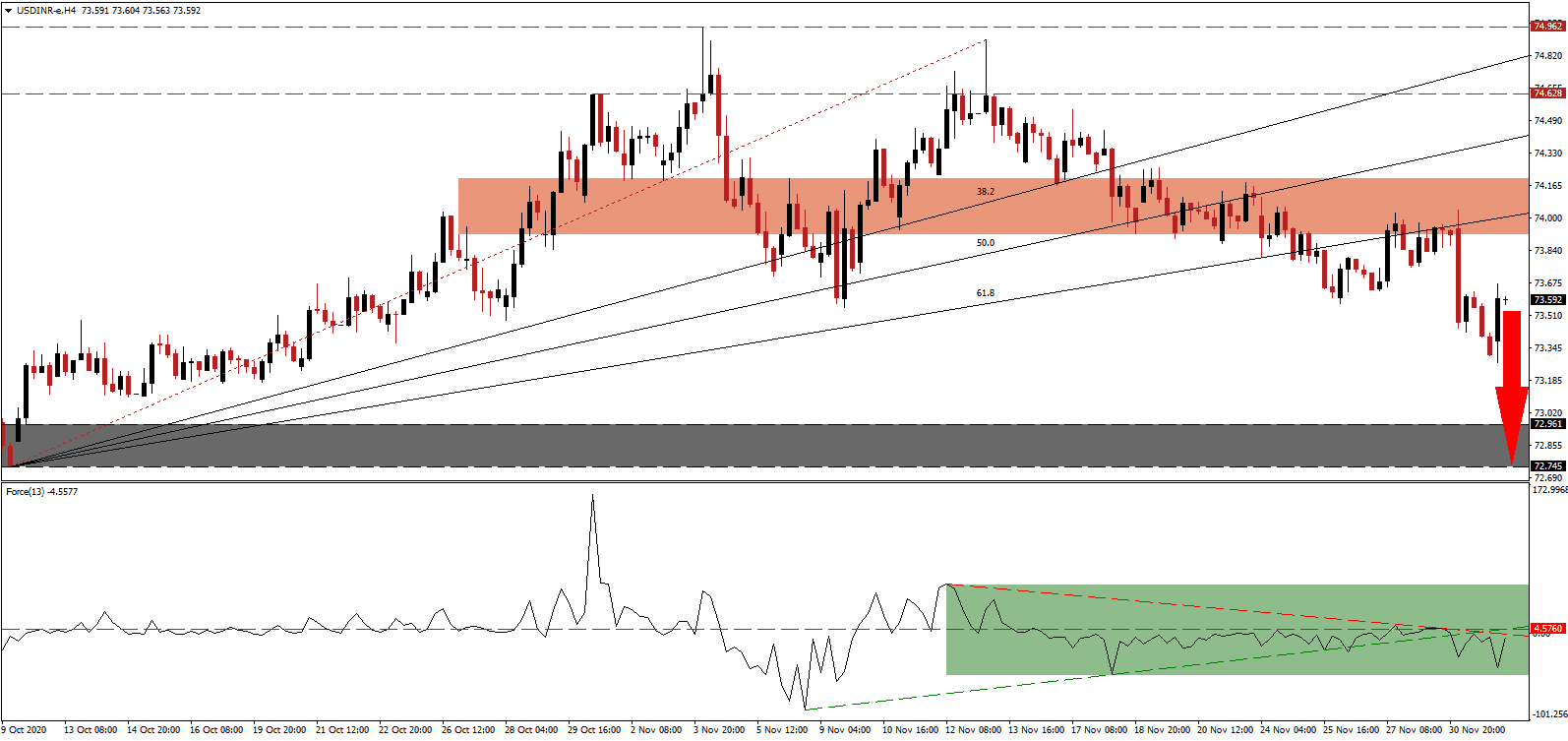

The Force Index, a next-generation technical indicator, recorded a lower low before retracing into its descending resistance level, as marked by the green rectangle. It remains below its horizontal resistance after moving below its ascending support level, which expanded downside pressures. Bears are in full control over the USD/INR with this technical indicator below the 0 center-line.

Moody's Investors Service also struck an optimistic tone for GDP for the fiscal year 2021-2022, suggesting a 10.8% growth rate. It did note that the low base will support headline numbers, but the two-year total for this decade will leave India essentially with no growth. For an emerging economy, no-to-low-growth can have a similar negative impact as a recession in a developed economy. Bearishness rose after the USD/INR corrected through its resistance zone located between 73.916 and 74.200, as marked by the red rectangle.

Inflationary pressures will keep the Reserve Bank of India (RBI) on the sidelines after lowering rates to 4.00%. The October CPI surged by 7.61%, the fastest expansion since 2014, and well-above the RBI inflation target of 4.00%, which has an upper range of 6.00%. Following the rejection by its ascending 61.8 Fibonacci Retracement Fan Resistance Level, the USD/INR remains positioned to accelerate down into its support zone between 72.745 and 72.961, as identified by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.600

Take Profit @ 72.750

Stop Loss @ 73.850

Downside Potential: 8,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.40

Should the Force Index move above its ascending support level, serving as resistance, the USD/INR could partially retrace its most recent contraction. With bearish pressures on the US dollar expanding, any advance will offer Forex traders a secondary selling opportunity. The upside potential remains limited to 50.0Fibonacci Retracement Fan Resistance Level.

USD/INR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 74.050

Take Profit @ 74.350

Stop Loss @ 73.850

Upside Potential: 3,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.50