New daily COVID-19 infections continue to rise across India, which is on course to become the second country behind the US to report more than 10,000,000 cases. Economist Abhijit Sen counters the Reserve Bank of India (RBI) assessment for a fiscal 2020-2021 GDP drop of 7.5% with an estimated 10.0% plunge. The USD/INR correction can accelerate following the breakdown below its adjusted short-term resistance zone.

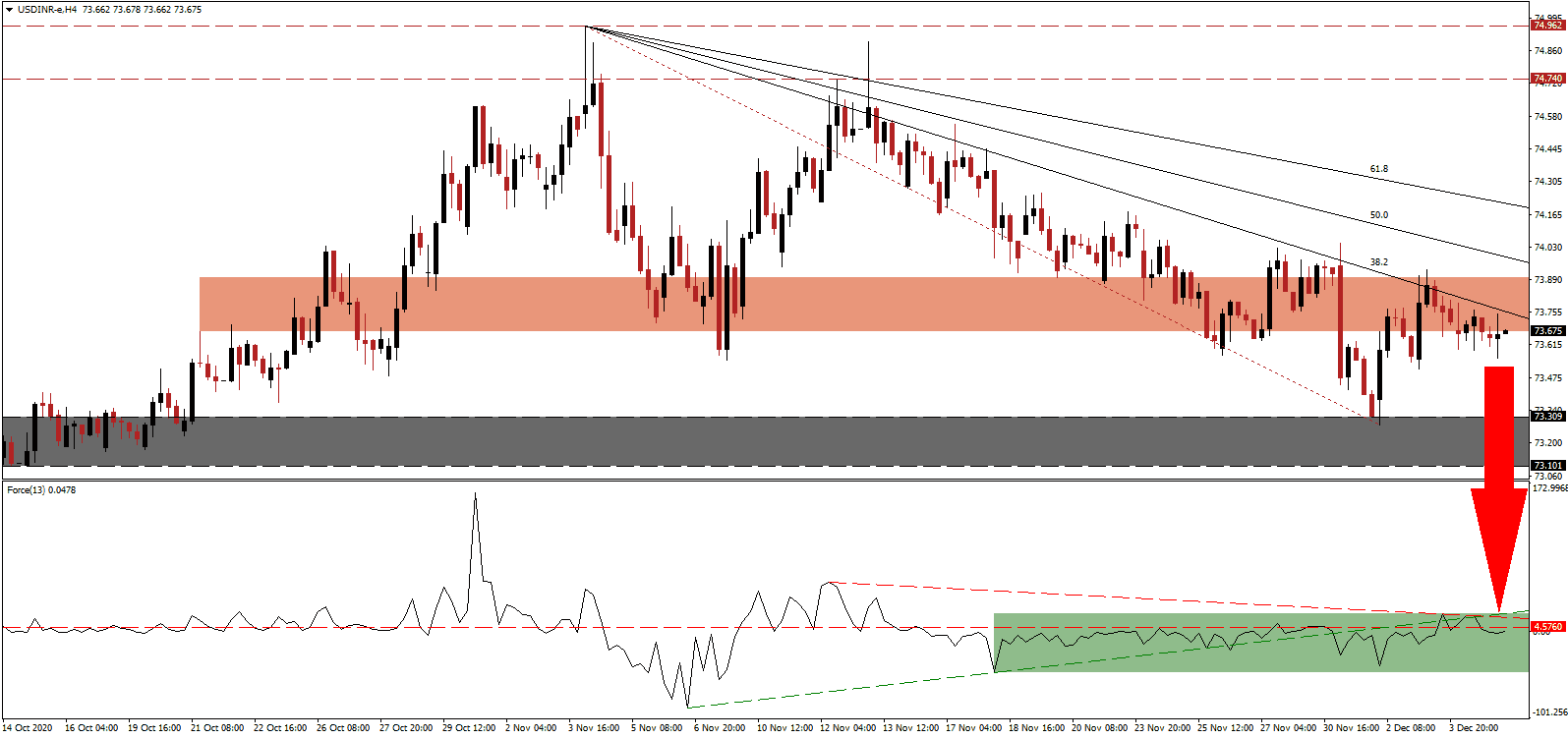

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level before retreating after the descending resistance level rejected a further advance. Bearish momentum continues to expand with the Force Index below its ascending support level, as marked by the green rectangle, and below the 0 center-line. Therefore, the USD/INR remains under the control of bears.

Chinese exports to India dropped by 13% in the eleven months ending November, while imports rose by 16%. Indian Prime Minister Narendra Modi embarked on a policy to discourage consumers from buying products manufactured in China amid tensions. Breakdown pressures in the USD/INR grow following the move below its short-term resistance zone located between 73.670 and 73.899, as identified by the red rectangle.

India continues to struggle with its agricultural sector and angry farmers, the third leg of its economy on which 60% of Indians depend, but the government fails to support it. The USD/INR faces breakdown pressures from its descending Fibonacci Retracement Fan sequence, favored to force it into its support zone between 73.101 and 73.309, as marked by the grey rectangle. A collapse into its next one between 71.409 and 71.710 can follow.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.650

Take Profit @ 71.650

Stop Loss @ 74.050

Downside Potential: 20,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 5.00

In case the Force Index reclaims its ascending support level, serving as resistance, the USD/INR may experience a temporary price spike. With conditions in the US deteriorating swiftly, the upside potential remains confined to its intra-day high of 74.445. Forex traders should sell any rallies from current levels.

USD/INR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 74.200

Take Profit @ 74.400

Stop Loss @ 74.050

Upside Potential: 2,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.33