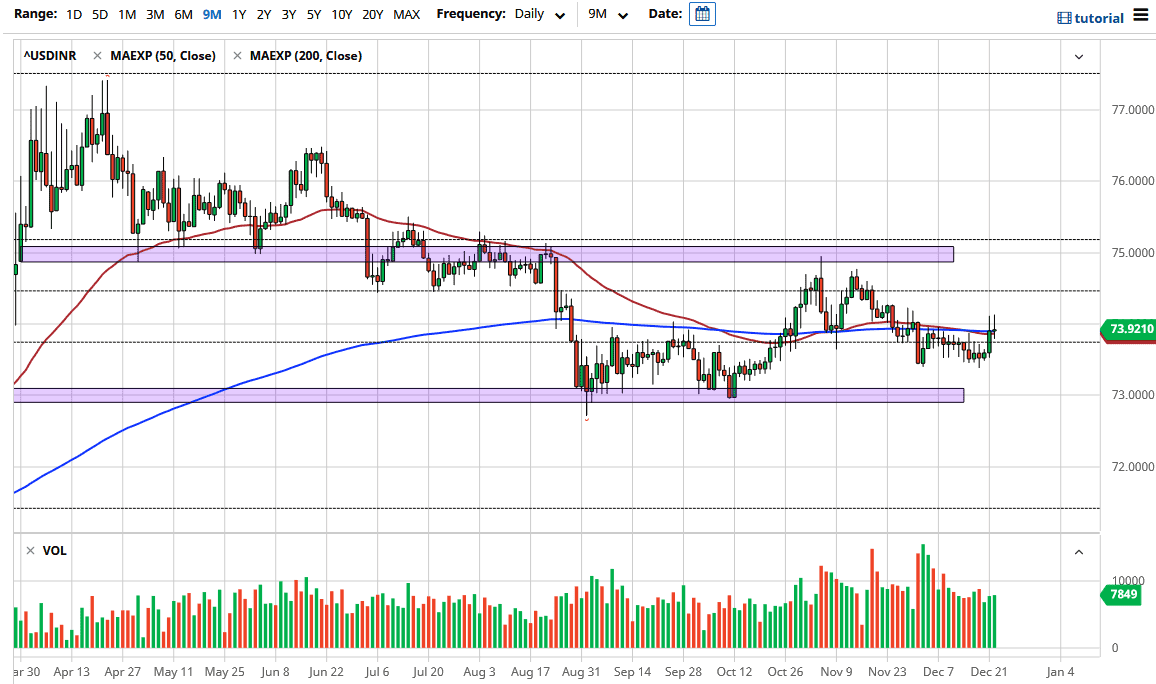

The Indian rupee has been very choppy lately as the USD/INR continues to see a lot of grinding in a low liquidity environment. It is holiday trading, so it is difficult to imagine that the market will suddenly take off in one direction or another for a sustained move now that we are past one of the major catalysts out there for the US dollar: the stimulus bill. Congress has already passed that, so the US dollar losing value makes sense, but as we have seen before, the Forex market was well ahead of that. We are simply dancing around the 50-day EMA as the market is flattening out. The ₹74 level above has been resistance, but it has also been supported recently as well.

The ₹74 level is very important, as it is the midpoint between the ₹73 level on the bottom and the ₹75 level on the top. The market is likely to see a lot of choppy behavior heading into the end of the year, because liquidity is a major issue and we are essentially right in the middle of the overall playing field. It is difficult to make a bigger move for significant strength. The candlestick for the trading session on Tuesday is a neutral candlestick that was a sign of indecision, so I would not read too much into it.

The pair is probably going to continue to follow the overall US dollar, as it is an excellent indicator for risk appetite. The US dollar strengthening will send this market higher, reaching towards the ₹75 level. You will need to pay attention to the US Dollar Index, as it can give you an idea as to where we will go. Remember, the Indian rupee is an emerging market currency, so it will be more volatile than some of the other currencies like the euro, pound, etc. If the US dollar strengthens, it most certainly will show itself here. However, if we see a general run from the US dollar, that could send this market plunging towards ₹73, possibly breaking down below to the ₹72 level. Until then, being patient is the only thing you can do.