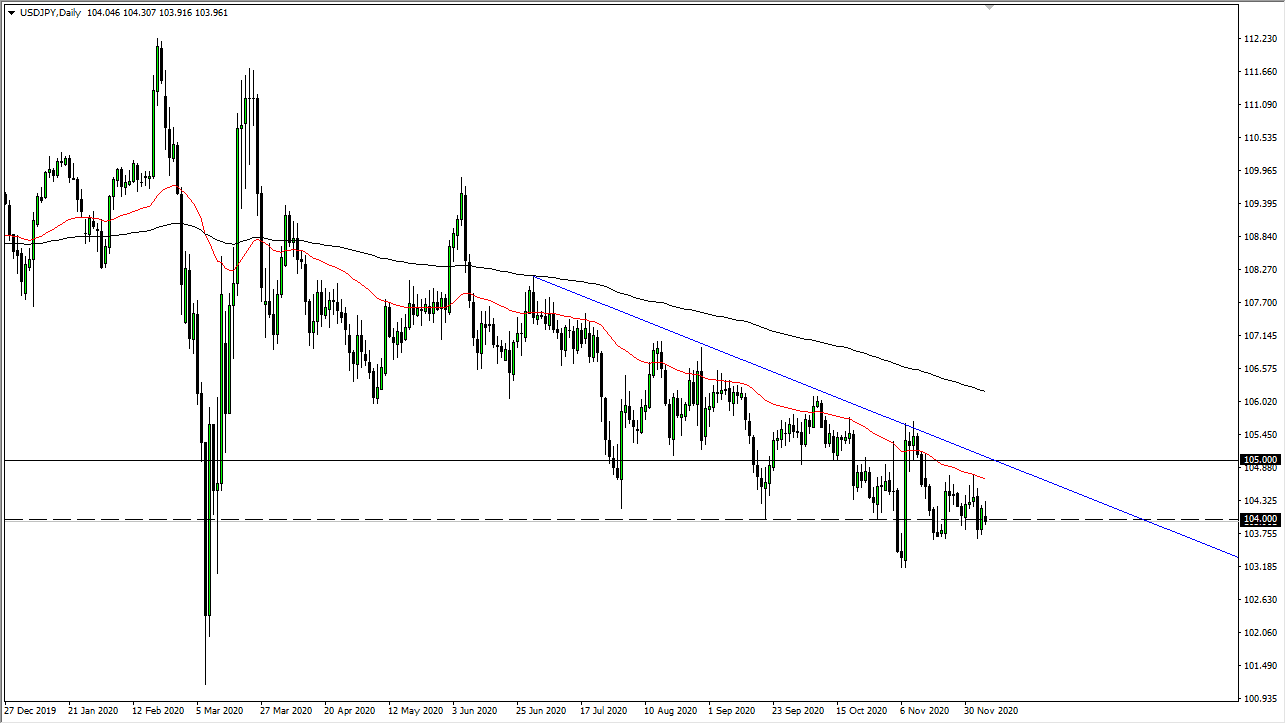

The US dollar had initially rallied during the trading session on Monday, but then turned around to show signs of exhaustion. The candlestick for the day is an inverted hammer, so it will be interesting to see if we can continue to break down a bit and continue the overall longer-term downtrend. The ¥103.70 level seems to be supportive, and if we can break down below there it is likely that the market could go looking towards the ¥103.25 level. Furthermore, breaking down below that opens up the possibility of a move down to the ¥102 level.

Just above, the 50-day EMA continues to be massive resistance and has been somewhat reliable over the last several weeks, which extends all the way to the 200-day EMA. Furthermore, we have a downtrend line in that same general vicinity that comes into play, so there are plenty of reasons to think that sellers will come back in and push this market lower. After all, with the Federal Reserve doing so much quantitative easing, it follows that we would see a lot of downward pressure. Also, the Japanese yen is a safety currency, so it is a bit of a “double whammy” as to why we may fall from here.

The Bank of Japan has been relatively quiet when it comes to this pair, which is a bit refreshing considering that it has a long history of being interfered with, at least verbally when it gets a bit too negative. In fact, the Bank of Japan has even gone so far as to intervene occasionally, and that could come into play if we get down towards the ¥102 level. I look at short-term rallies as opportunities to sell this pair and pick up “cheap yen”. In fact, I have no scenario in which I'm willing to be a buyer, unless we suddenly see the Federal Reserve completely turn its schemes around, which is something that does not look very likely to happen. We will probably continue the overall grind lower more than anything else. Even if the US dollar were to suddenly pick up strength, it would be somewhat muted at this point against the yen.