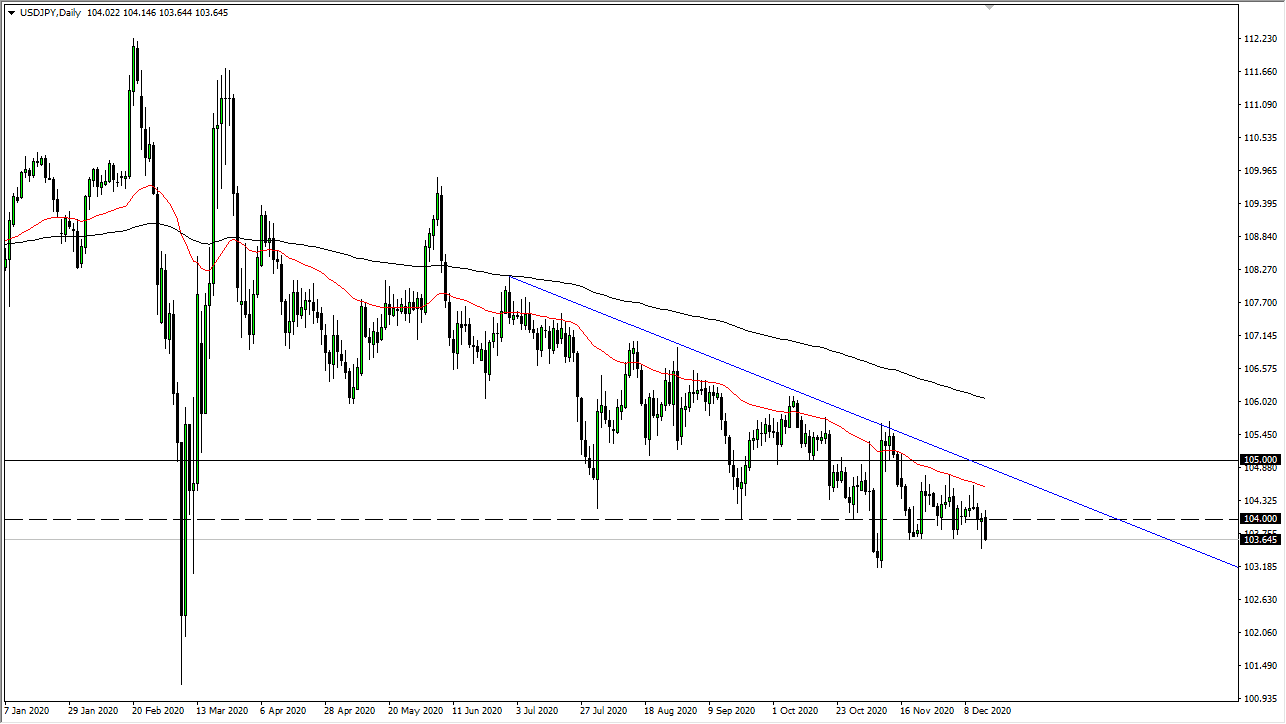

The US dollar initially tried to rally during the trading session on Wednesday, but then fell hard as we try to crash through the support level that has been so important for the last several weeks. At this point, if we can break down below the bottom of the candlestick from the Monday session, that would open up a move down to the ¥103.25 level, and then possibly the ¥102 level. The market has been in a downtrend for quite some time, suggests that we will go lower. Short-term rallies that show signs of exhaustion will be the favored trade.

With the Federal Reserve's coming announcement on Wednesday, we could get a bit of volatility going forward, and as a result, a bounce. The ¥104 level could be a target, at least for the short term. In that event, the market is likely to see a lot of selling, extending all the way to the 50-day EMA. The market will continue to be noisy in general, but clearly it favors the downside from a longer-term perspective.

I have no scenario in which I'm willing to buy this pair, because we have too much in the way of technical resistance above and the Federal Reserve is going to work against the value of the US dollar. The downtrend line will cause resistance, and then the ¥105 level after that. With the strong downtrend that we have seen for some time, it follows that we will eventually see sellers regardless of what happens, and we could get an opportunity to take advantage of any type of move during the Asian and possibly even the European sessions. We are going to go much lower, but we need a “nudge” from the Fed to make that happen. I suspect that at 2 o’clock New York time on Wednesday, we may get that potential encouragement.