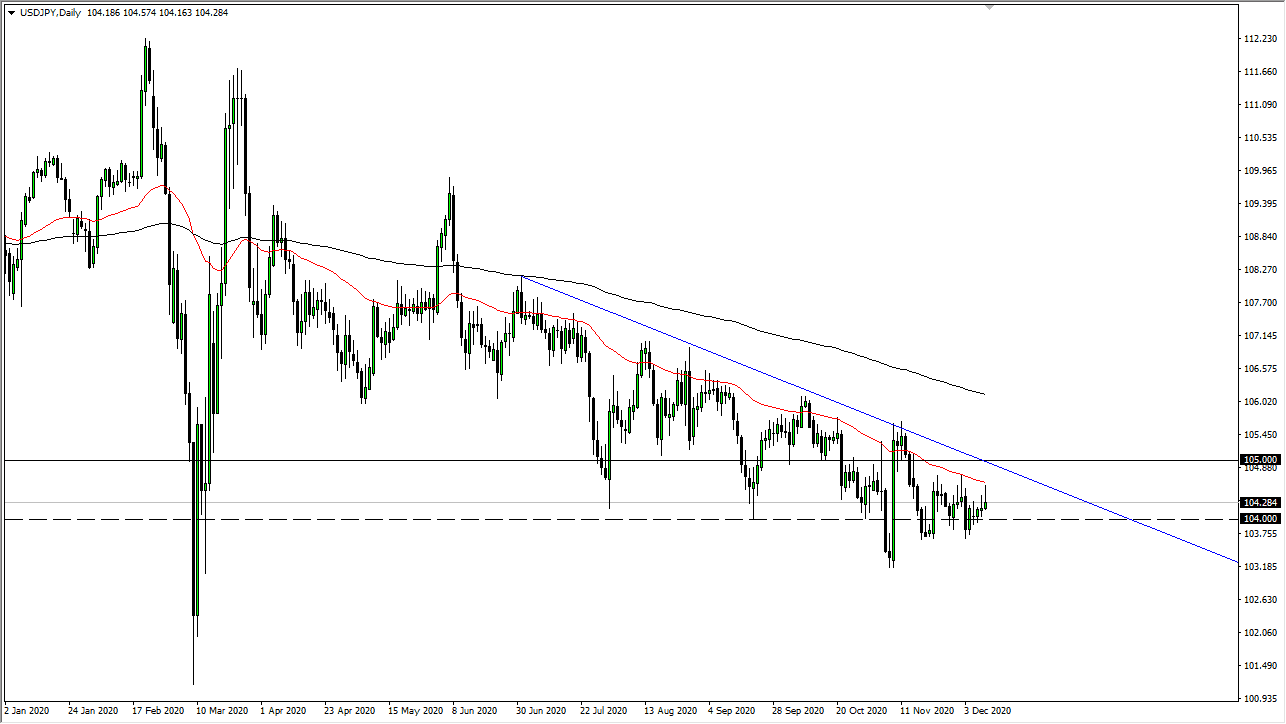

The US dollar rallied initially during the trading session on Thursday, reaching towards the 50-day EMA. But, as we have seen multiple times over the last week or so, every time we rally it is sold into. The market is likely to see another attempt to break down, but we obviously have a certain amount of buying pressure underneath as well. After all, the “risk on" trade has been taken over as of late, and that typically will lift this pair as people try to get rid of the Japanese yen, as it is such a safety currency. One of the areas in which I see quite a bit of support is the ¥103.70 level.

If we can break down below that level, then the next area of significant support is close to the ¥103.25 level, and then perhaps even lower, maybe reaching all the way down to the ¥102 level. It looks as if the stimulus is starting to weigh upon the greenback overall, and that sends this market lower every time it tries to rally. Furthermore, above the 50-day EMA there is a massive amount of resistance, not only in the form of the 50-day EMA itself, but also a downtrend line, the ¥105 level, and then the 200-day EMA beyond all of that. In fact, it is not until we break above the 200-day EMA that I would be a buyer in this pair, something that we are nowhere near as the 200-day EMA is a bit over the ¥106 level.

Looking at all of the choppiness in this market, it is going to be difficult to hang onto, but I still favor fading rallies. Fading rallies has worked for some time, although the first thing that you should notice from the last couple of weeks is that the range is most certainly tightening. This tells me that inertia is starting to build in this market, so eventually we will get some type of larger breakout. At this point, I would have to assume that it is a move to the downside, but I obviously need to see a larger candlestick to get things moving, and perhaps some type of fundamental catalyst out there to make it happen.