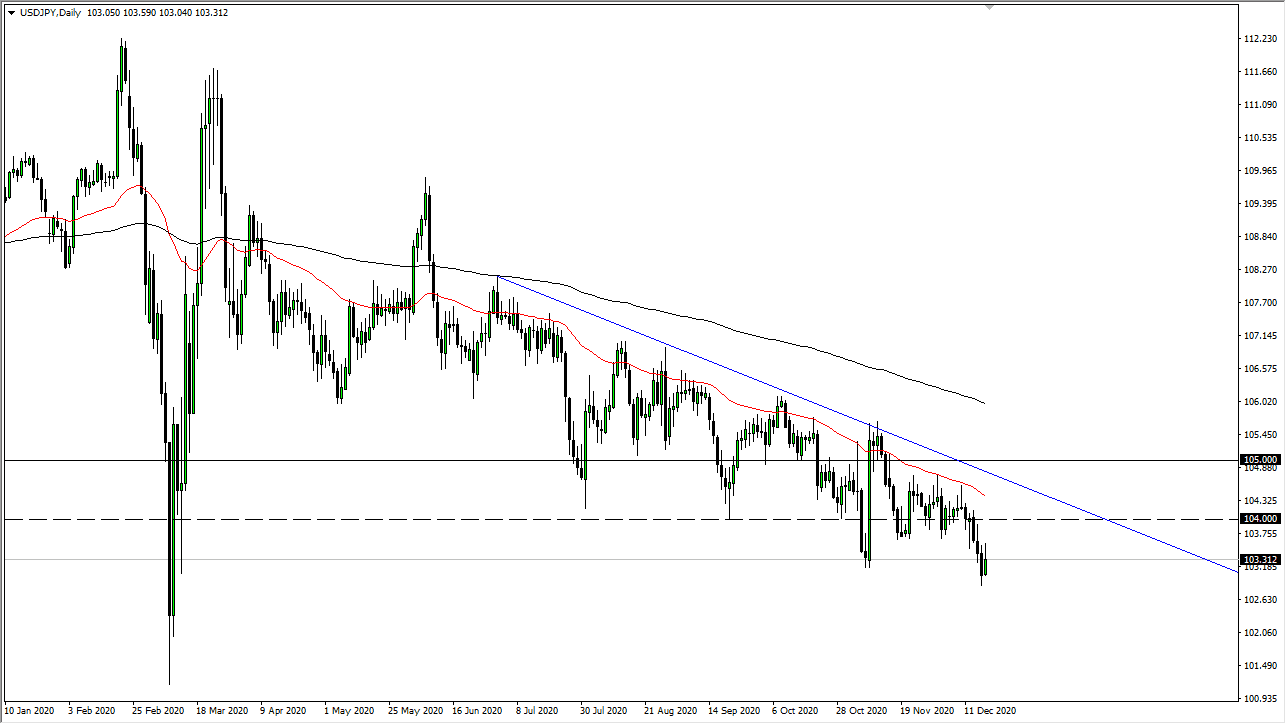

The US dollar initially tried to rally against the Japanese yen, but pulled back to give up about half of the gains. This market will continue to go much lower, but we may have some volatility ahead over the next couple of sessions. We have recaptured just above the ¥103 level, so we may have a bit more in the way of bullish pressure, but I find it very difficult to imagine that the market is suddenly going to take off to the upside. I believe that the ¥104 level will continue to be important resistance, so we will continue to see sellers.

If we did break above the ¥104 level, then we have to deal with the 50-day EMA, which should cause a certain amount of resistance as well. Beyond that, we also have the downtrend line, and then the ¥105 level. This is a market that will continue the overall downtrend in the short term, but we are getting a bit stretched when it comes to the dollar selling. I think that we could get a bit of a bounce, but that bounce will continue to attract sellers as stimulus will almost certainly continue to be a major driver of where the US dollar goes.

Furthermore, the Japanese yen is considered to be a “safety currency”, which could also have a certain amount of importance built into it as well. If we can break down below the lows of the Thursday session, that opens up the door to reach down towards the ¥102 level, perhaps even lower than that. Once we get to that area, though, one would have to think that there is going to be a significant amount of support. The market continues to see noisy behavior, but as we have seen so much of a downtrend over the last several months, it is difficult to imagine that suddenly things are going to change. The US dollar has been in a downtrend for quite some time and people are anticipating that it is only going to continue.