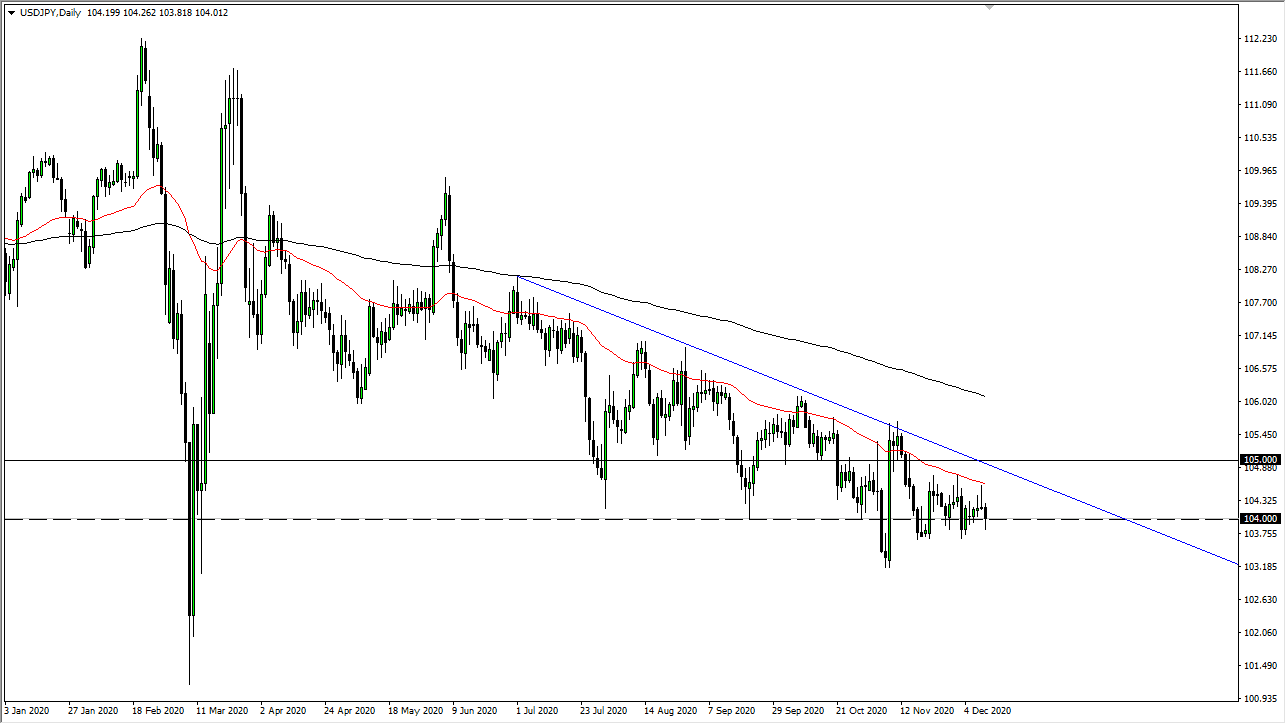

The US dollar fell a bit during the trading session on Friday to break down below the ¥104 level, but we have recovered that level yet again. This is a market that seems as if it is content to dance between the ¥103.70 level on the bottom and the ¥104.50 level on the top. Furthermore, the 50-day EMA above is offering resistance and has been tested a couple of times.

Longer term, we are most certainly in a downtrend, and it is easier to sell this market. However, as we are tightening up, it is difficult to hang on to a position for any real length of time. I like the idea of fading short-term rallies that show signs of exhaustion, so I am more than willing to take advantage of this trade, but I am not expecting anything big in the short term. However, one thing that could kick this thing off is stimulus. If the stimulus package in the United States finally gest passed, and if it is large, that should send this market plunging as it will sell the US dollar off against almost everything.

However, this pair does tend to rally in a “risk-on” type of scenario, so it is going to struggle due to the fact that the “risk-on" move will be all about the US dollar losing value. I like the idea of fading rallies and do not really have a scenario in which I'm willing to step in and start buying. After all, the 50-day EMA is offering resistance, there is a downtrend line, and there is the ¥105 level. After that, the 200-day EMA above also offers resistance. In fact, it is not until we break above the 200-day EMA that I will even start asking questions about buying this pair.

If we can break down below the 103.70 level, then we will go looking towards the 103.25 level, followed by the ¥102 level given the previous structure of the market. In the meantime, it is simply a matter of fading those short-term rallies, but there is much more in the way of resistance than there is support in this general vicinity.