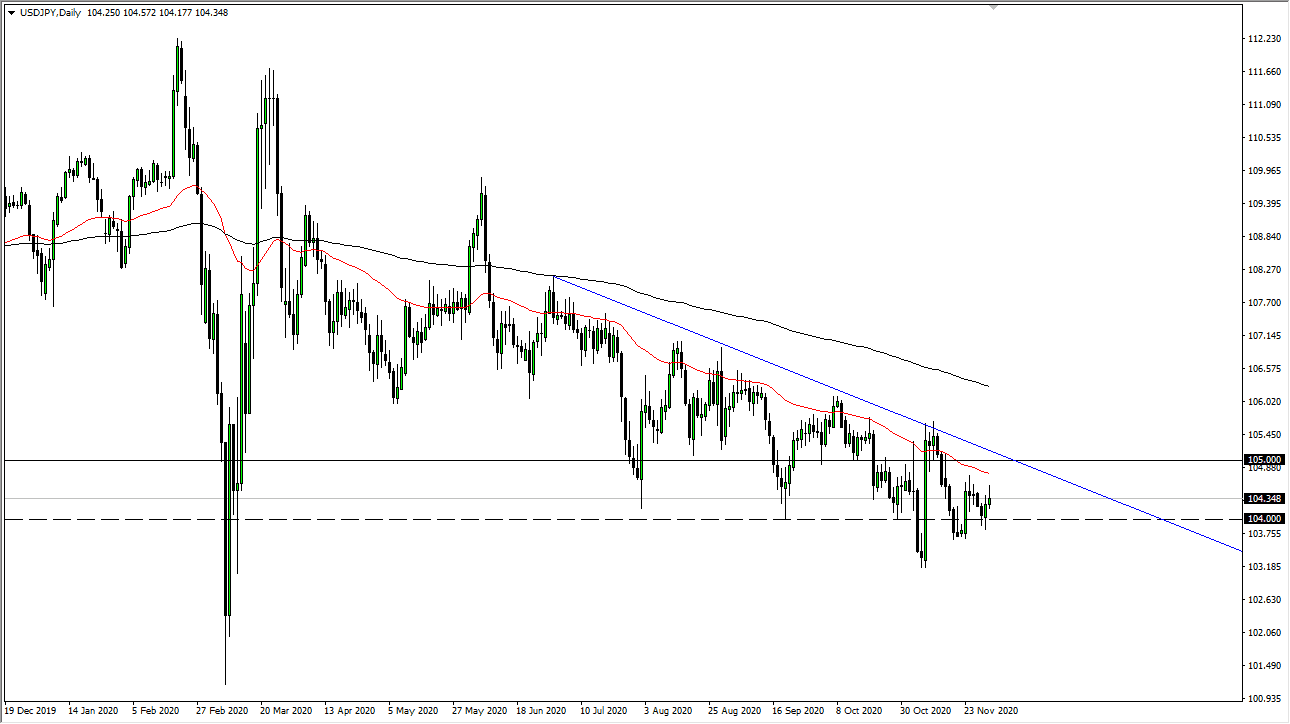

The US dollar rallied initially during the trading session on Tuesday but gave back the gains in order to form a shooting star. This is a very negative candlestick that people will be paying attention to, and it suggests that we are continuing our move lower. Nonetheless, one thing that we should keep in mind is the fact that the most recent lows have been higher, so I am a bit more hesitant in shorting this pair than I typically would be.

In general, the US dollar will be sold off, but I think one of the biggest factors here that could make this pair a bit more difficult is the fact that the USD tends to rise against the Japanese yen in more of a “risk-on move.” We are clearly seeing more risk being taken out there, so it tends to work against the value of the yen itself. If you are looking to sell the US dollar, you probably have more latitude doing it against the euro or perhaps even the British pound, barring a Brexit headline.

One of the biggest winners has been the New Zealand dollar and I think that will continue to be the case. So either way, what we are going to see is US dollar weakness, but it may be slightly supported here by the fact that the Japanese yen is considered to be safety. Just above, I see the 50-day EMA as potential resistance, which is painted in red. This sits just below the ¥105 level and a major downtrend line that you see on the chart. Nonetheless, I do think that there are multiple levels underneath that could cause some trouble, so it is probably best just to sit on the sidelines as there is no real clarity here, other than the fact that eventually the downtrend will probably continue. If you have to put a position in, its most certainly going to be a selling position more than anything else. But I think there are easier ways to make money in the Forex markets, although we certainly have an overall bias. I have no scenario in which I'm willing to buy this pair.