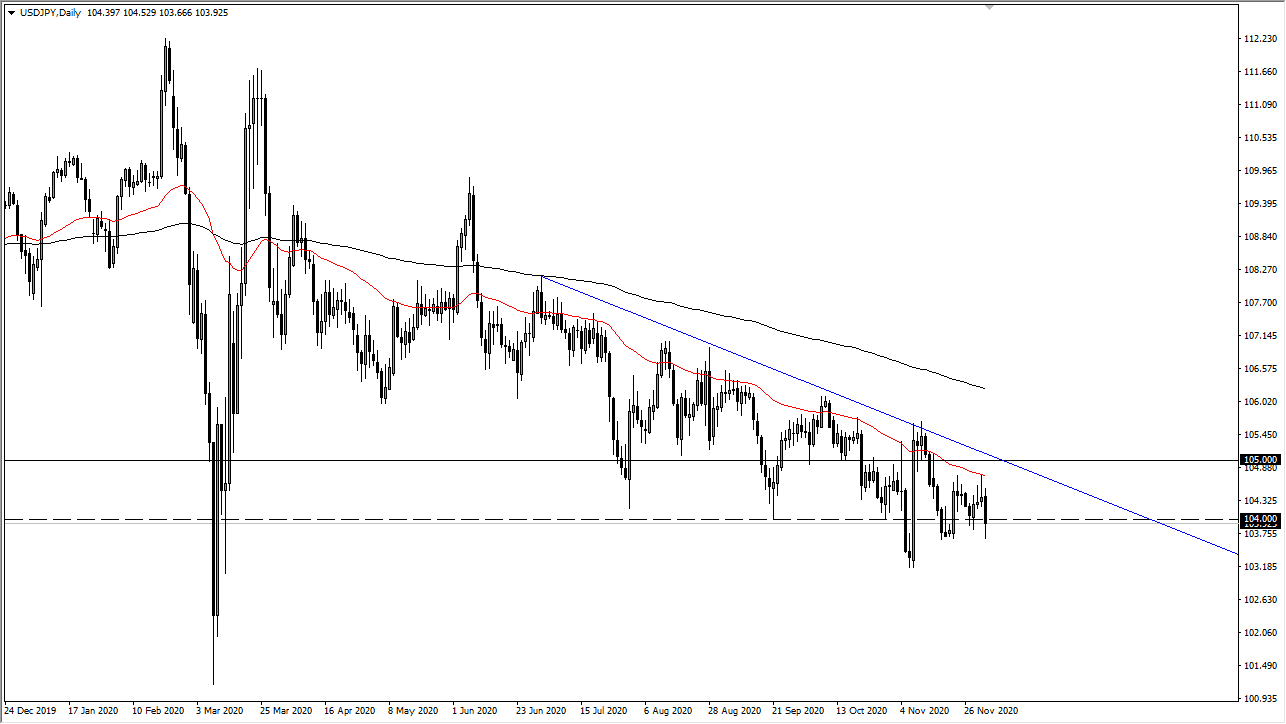

The US dollar fell during the trading session on Thursday to break down below the ¥104 level. This was an interesting area considering that there were a large amount of options expiring at that level during the trading session. The market is likely to continue to go lower due to the fact that the US dollar itself is very soft. That being said, it also has the aspect of risk appetite affecting the market as well.

The shape of the candlestick does suggest that we are seeing a little bit of pushback underneath, but ultimately the longer-term trend is most certainly negative. At this point, I believe that if we break down below the bottom of the candlestick for the trading session, we will dive much deeper. The fact that the Non-Farm Payroll announcement comes out during the trading session on Friday makes the idea of volatility in this pair almost a given as it is so highly influenced by the NFP most of the time.This is a market that has been trying to figure out where to go next, and now I believe it has shown that the downside is still very much in control. At this point, I would be all over a shorting opportunity on signs of exhaustion, or perhaps a breakdown below.

To the downside, the ¥103.25 level would be an area that I think there could be a bit of support and if we break down below there it is likely that the dollar will then start looking at the possibility of a drop down to the ¥102 level. That was where we had seen massive support previously. That being the case, I do believe that it is only a matter of time before sellers overwhelm this market as we have been in such a strong downtrend for so long. Recently we have been grinding back and forth, but it certainly looks as if the market is starting to “lean” to the downside. With all this being said I think it is only a matter of time before the breakout, so I have no interest in buying this pair and I do believe that the actions of the Federal Reserve and the US government will continue to put downward pressure on this pair. Furthermore, the Japanese yen will also be favored due to its “safety status.”