The USD/JPY is stabilizing under downward pressures that pushed the pair towards the 103.68 support at the time of this writing. This move comes in anticipation of the monetary policy decisions from the US Federal Reserve Bank and Chairman Jerome Powell's statements. Since the beginning of this week’s trading, the pair has been moving in a narrow and limited range amid bearish stability. Along with the decisions from the Federal Reserve Bank, financial markets and investors are eagerly waiting the announcement of stimulus plans to support the US economy in the face of the pandemic. In this regard, a group of lawmakers from both parties unveiled a detailed relief proposal for COVID-19, and House Speaker Nancy Pelosi and Treasury Secretary Stephen Mnuchin spoke late Monday about the urgent need to approve aid for the faltering economy.

What contributed to the pressure on the US currency as a safe haven was market stability amid hopes for an improvement in the global economy next year, as the COVID-19 vaccines become widely distributed. There might be a vaccine developed by Moderna, which the National Institute of Health says may be on the cusp of regulatory approval after the US Food and Drug Administration said its preliminary analysis confirmed its safety and efficacy. Hundreds of hospitals and healthcare facilities would thus receive their first shipments of the vaccine developed by Pfizer and BioNTech.

Investors were also alerted by the continuing deep partisan rift that prevented Congress from providing another dose of financial support to the US economy, at a time when economists and investors are calling for more aid to unemployed workers and severely affected industries.

According to the results of recent economic data, the number of weekly US jobless claims increased to levels close to the million mark, as governments across the country and the world resumed varying degrees of restrictions on corporate activity. Even without shutdown orders, the fear is that the increased number of deaths will drive customers away from businesses.

Therefore, passing another round of financial support from Washington could help the US economy confront what is expected to be a bleak winter, before vaccines help to approach normalcy next year. In general, concerns about a worsening epidemic and stop-and-start talks in Washington about boosting the economy have shaken markets in recent weeks, which recorded record profits as early as November due to hopes for the upcoming COVID-19 vaccines and relief from the end of the US presidential election.

The US Federal Reserve will announce its decision on Wednesday after having already lowered short-term interest rates to near zero, and having assured that rates will be maintained for a longer period even if inflation rises above its 2% target.

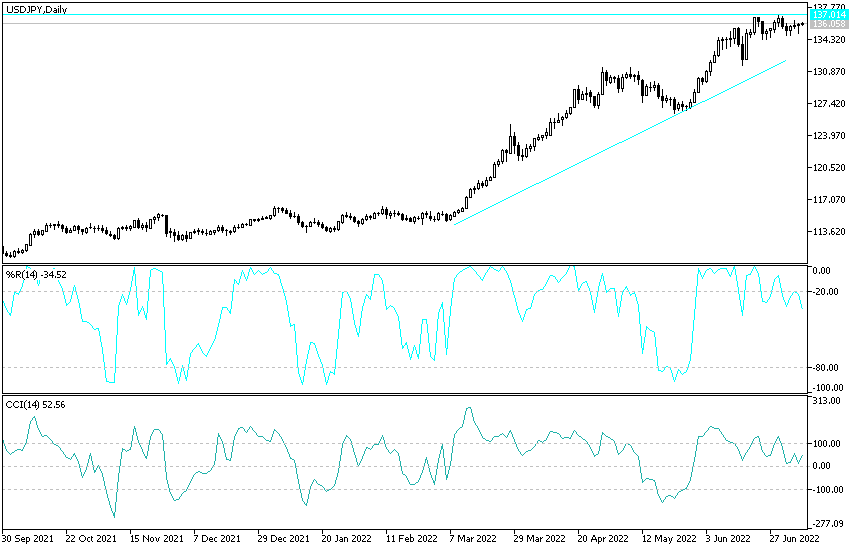

Technical analysis of the pair:

There is no significant change in my technical view of the USD/JPY performance, as stability around and below the 104.00 support is still supporting more bears’ control on the performance. The pair is moving towards stronger support levels, the closest of which are currently at 103.65 and 102.90 and 102.00 respectively, though I still prefer buying the pair from every drop. Technical indicators have reached strong oversold areas and are waiting for the opportunity to rebound upward instead of collapse further. On the upside, according to the performance on the daily chart, the 106.00 resistance must be breached to help the bulls control the performance.

Today's economic calendar:

For the JPY, the trade balance and the Manufacturing PMI reading will be announced. For the USD, we have the retail sales figures, the Industrial and Services Purchasing Managers Index, and most importantly, the monetary policy decisions of the US Federal Reserve and the statements of Governor Jerome Powell.