Ahead of an important testimony by Federal Reserve Governor Jerome Powell, the USD/JPY is trying to correct upwards, but with limited gains that reached the 104.35 level at the time of writing. This came after heavy losses for the pair recently pushed it towards the 103.82 support at the beginning of this week’s trading. Along with Powell's testimony and the announcement of US job numbers, investors will focus on whether US state governors will choose to impose tougher lockdowns to stem the second wave of COVID-19, as more closing restrictions may lead to curbing US stock markets. The Fed might then be likely to flood the markets with liquidity.

US cities and states are imposing new restrictions that threaten to further derail the recovery of the world's largest economy. The US already suffered a setback when lawmakers in Washington repeatedly failed in recent months to provide financial support to mortgage companies and households.

Los Angeles County announced new restrictions on Friday that will ask residents "to stay at home as much as possible" starting Monday, while San Francisco imposed new restrictions on commercial activity in the hospitality sector in addition to nightly curfews, according to The Wall Street Journal. Meanwhile, the Center for Disease Control (CDC) has estimated that up to 15% of Americans already have the COVID-19 virus.

In general, investors' concerns about the new restrictions could negatively and strongly affect the stock markets and provide safe haven support for the US dollar.

Commenting on the forecast, Zach Pandel, a Forex analyst at Goldman Sachs says, “Our economists are now expecting the Fed to increase the weighted average maturity of its treasury bond purchases at its December meeting. This would help preserve the long-term treasury returns contained in the near term and support our short recommendations in the US dollar.” The analyst expects the price of the GBP/USD to be 1.34 within three months and then to 1.44 by the end of 2021.

Financial markets will closely watch the possibility of preventing US government closures when the temporary spending law expires on December 11th. The preferred course of action by senior lawmakers such as House Speaker Nancy Pelosi, a Democrat from California, and Republican Senate Majority Leader Mitch McConnell, would be to agree and pass the Comprehensive Expenditure Act. But it can be difficult to bridge the bitter divisions over the long-delayed COVID-19 relief package that is a top priority for businesses, state and local governments, educators and more. In September, Pelosi came under fire by some in her own Democratic party for blocking President Trump's proposed $1.8 trillion stimulus relief package.

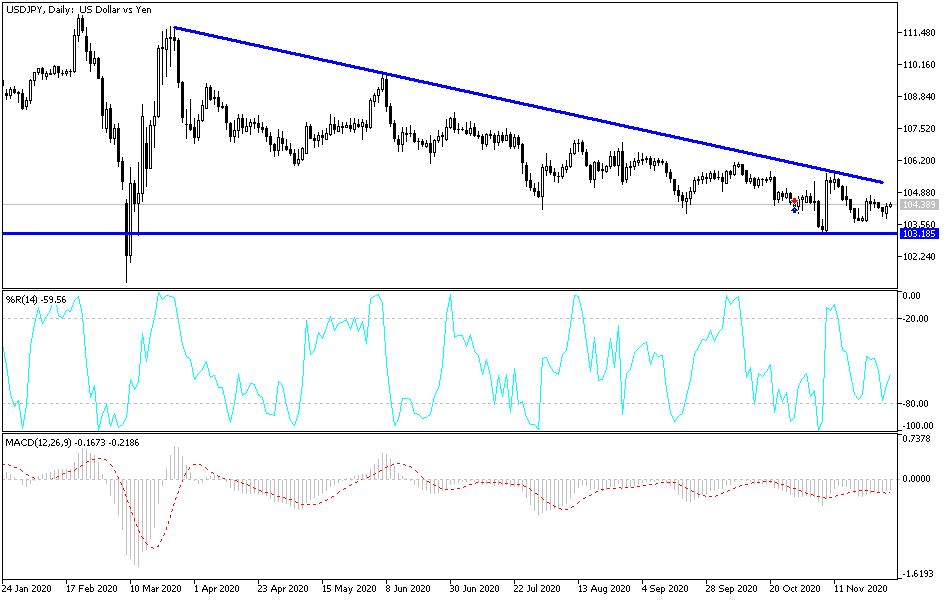

Technical analysis of the pair:

Despite recent rebound attempts, the general trend of the USD/JPY is still bearish, as it is the closest to returning to stability below the important support level at 104.00. Technical indicators reaching oversold areas give Forex investors the opportunity to buy and wait for a bounce expected at any time. The closest support levels - and the most important for buying - are currently at 103.85, 103.00 and 102.65, respectively. On the upside, as I mentioned before, there will be no opportunity for the bulls to strongly control the performance without moving towards resistance levels at 106.00 and 108.00, respectively. Otherwise, the bear will continue to dominate the performance of the pair.

Today's economic calendar:

In Japan, the unemployment rate, the rate of capital spending, and then the manufacturing PMI reading will be announced. For the USD, the ISM Manufacturing PMI and Construction Spending Index will be announced, and later on Fed Governor Jerome Powell will testify before Congress.