With nearly non-existent movement, the USD/JPY had a weak performance at the beginning of this week’s trading. The pair traded between 103.92 and 104.31, then settled around 104.00 on Tuesday. The bearish momentum is still stronger, with the US dollar lacking the momentum needed to control, while the yen remains the preferred safe haven for investors in times of uncertainty. Optimism regarding coronavirus vaccines was countered by fears of failure in Brexit negotiations, and anticipation for a US stimulus plan and European Central Bank announcements this week.

In general, such political concerns help to slow down the momentum of global financial markets, as is the case with the rise in the number of coronavirus deaths in most parts of the United States and Europe. The worsening pandemic is pushing governments around the world to reinstate restrictions on business to varying degrees, keeping customers out and threatening to derail the economy during what is expected to be a bleak winter. Friday's report showed that US job growth slowed sharply last month, and that the numbers may worsen.

If the US Congress fails to reach an agreement to revive the economy during the winter, losses in US stocks - and thus in other markets - may increase. For example, Chevron Corp.'s stock is down 2.8% amid concerns that the COVID-19 pandemic may choke off more global demand for oil and energy.

With time running out, US lawmakers concluded negotiations Sunday to approve a proposed COVID-19 relief bill that would provide nearly $300 in additional weekly federal unemployment benefits but not another round of $1,200 in direct payments to most Americans, leaving this to Joe Biden to work out with Congress. The $908 billion aid package that will be released will be linked to a larger spending budget at the end of the year that is required to avoid a government shutdown at the end of next week.

Cash payments were commonplace when they were first distributed following the outbreak, and on Friday, Biden expressed hope that a second wave would come after the weekend negotiations. The plan being worked on by a group of Republican and Democratic senators is less than half of the Democrats’ $2.2 trillion payment and nearly twice the "target" package of $500 billion proposed by Senate Majority Leader Mitch McConnell.

President Trump added more Chinese companies to the blacklist. China's trade surplus with the United States reached $37.42 billion in November, and according to a survey of purchasing managers, the Chinese manufacturing sector grew in November by the most in a decade. Orders for manufactured goods continued to grow, led by more steady domestic demand. The growth in the new export business was not as specific as it was in the total orders.

Last week, the Organization for Economic Cooperation and Development said activity in China will return to its previous path, with growth of 8% in 2021 and 9.4% in 2022.

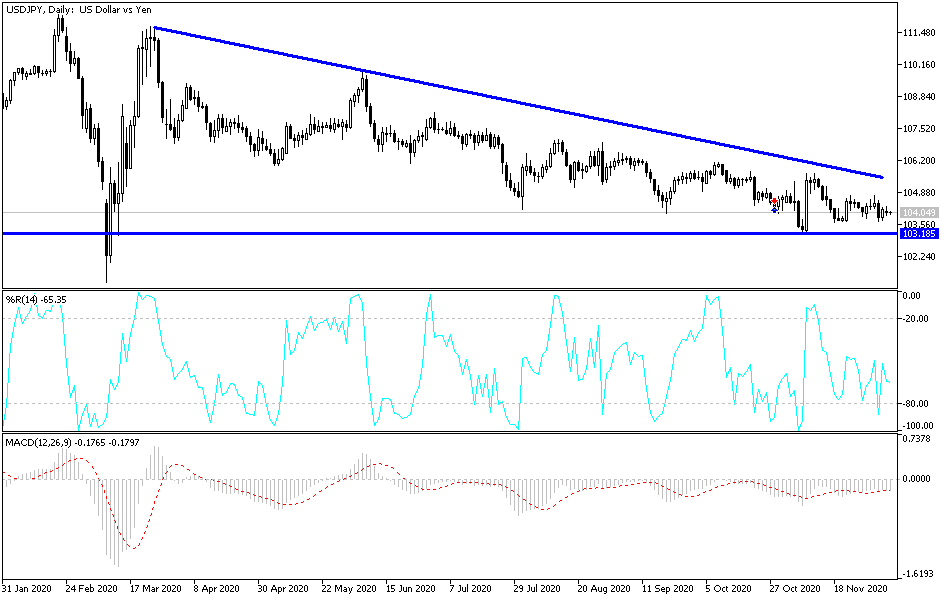

Technical analysis of the pair:

I do not see any technical change in the USD/JPY performance, as stability around and below the 104.00 support will support the bears' control to move towards stronger support levels, the closest of which are currently at 103.85, 103.20 and 102.55. At the same time, those levels push technical indicators on the daily chart towards oversold areas. Therefore, it is more appropriate to consider buying the pair while waiting for the USD moment to gain momentum to compensate for recent losses. On the upside, it is important to rebound towards the 106.00 resistance, so that bulls will have a stronger opportunity to capture the performance.

Today's economic calendar:

In Japan, the rate of GDP growth, current accounts and Japanese household spending will be announced. Inhe United States, the non-farm productivity rate and the cost of employment index will be released.