Since the beginning of this week's trading, the USD/JPY bullish rebound attempts have been weak. The pair remains stable below the 104.00 support, which confirms the extent of the bears’ control of performance. They have recently managed to push the pair towards the 102.88 support, the lowest level for the pair since last March. The recent bounce attempts did not exceed the 103.88 resistance, and it settled around the 103.60 level as of this writing. This is a time when no strong moves are expected for the currency pair, with the economic calendar being empty of important and influential economic releases, and investors preparing for the Christmas and New Year holidays.

The pair has not been affected by reports that China's market regulator has launched an antitrust investigation of e-commerce giant Alibaba Group, which has intensified official efforts to tighten control over the country's fast-growing tech industries. China is also ramping up its scrutiny of the practice of community group buying, summoning some of the country's largest tech companies for discussions as part of its antitrust campaign.

The Chinese State Administration for Market Regulation also recently summoned six companies, including Alibaba and other e-commerce platforms such as JD.com and Pinduoduo, gaming company Tencent, food delivery company Meituan and trip-sharing company Didi Chuxing to talk about the potential implications of any monopoly attempts.

The number of Americans seeking unemployment benefits decreased by 89,000 last week to 803,000. However, that number is still high, which is evidence that the US labour market is still under pressure nine months after the coronavirus outbreak that pushed the US economy into recession and caused millions to lay off workers.

The latest figure, released by the US Labour Department, shows that many employers are still cutting jobs as the pandemic tightens work restrictions and forces many consumers to stay home. Before the virus spread, the number of unemployed claims was around 225,000 a week before it reached 6.9 million in early spring when efforts to contain the virus stabilized the economy. The pace of layoffs has slowed since then, but remains historically high in the face of a resurgence of COVID-19 cases.

Commenting on this, Joshua Shapiro, chief US economist at economic consulting firm Maria Fiorini Ramirez, Inc., wrote: “The fact that more than nine months after the crisis, initial claims are still running at such a high level, is, in absolute terms, bad news. With the epidemic worsening again, the claims will likely remain very high for some time."

Also, the latest data on unemployment claims came on the same day that the government reported that consumer spending - the main driver of the economy - declined in November for the first time since April. The 0.4% decline, which came in the midst of the crucial holiday shopping season, heightened concerns that weak consumer spending will slow the economy in the coming months. Economists have suggested that the viral crisis, combined with declining incomes and cold weather, will likely push Americans back in November.

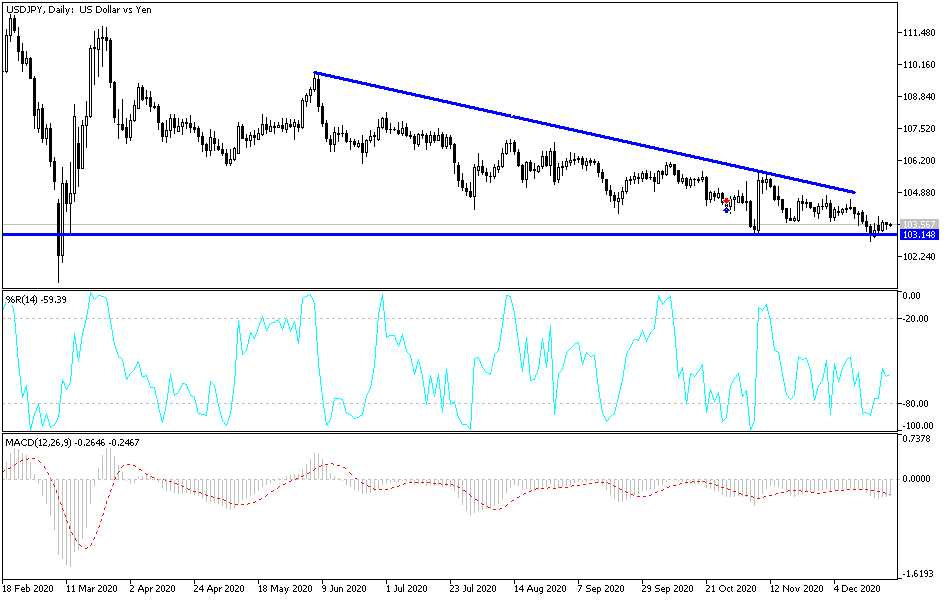

Technical analysis of the pair:

There is no change in my technical view of the USD/JPY performance, as the bears are still strongly dominating the performance. Stability around and below the 104.00 support will push the bears to move towards stronger support levels, which are currently closest to 103.25, 102.90 and 101.80. At the same time, they are levels that push technical indicators strongly to oversold areas. Accordingly, it is better to buy from there instead of thinking about new sales. On the upside, I still see the 106.00 resistance as a first stage of bulls reigniting and starting to reverse the current downside.