After five trading sessions in a row, during which the USD/JPY tried to bounce back up, the pair resumed its downward movement and stabilized around the 103.33 support. Gains of the rebound to the top did not exceed the 103.90 resistance, as investors have largely abandoned the US dollar since the announcement of vaccines and Trump's approval of emergency stimulus plans to contain the pandemic's devastating effects on the US economy.

US home prices jumped in October by the most in more than six years, as a buying rush fuelled by the epidemic drove the number of properties available for sale to record levels. This combination of strong demand and limited supply drove home prices up 7.9% in October compared to 12 months ago,. According to the S&P CoreLogic Case-Shiller Home Price Index, this was the largest annual increase since June 2014.

The coronavirus outbreak has forced millions of Americans to work from home and has curtailed other activities such as eating out, going to the movies or gyms. This is leading more people to look for homes with more space for a home office, larger kitchen or workspace. Commenting on the findings, Craig Lazara, Managing Director at S&P Dow Jones Indices, said: "The data from the past several months are consistent with the view that COVID has encouraged potential buyers to move from urban apartments to suburban homes."

Lazara also said that all the 19 cities recorded more year-on-year price gains in October compared to September. Detroit was not able to fully report home sales data due to delays related to the coronavirus shutdown. The largest price increase was in Phoenix for the seventeenth consecutive month, as house prices were up 12.7% from a year ago. It is followed by Seattle with 11.7% and San Diego with 11.6%.

US home sales declined in November, according to the National Association of Realtors, after rising steadily in the previous five months. Even after the downturn, sales were nearly 26% higher last month than last year. Sales were also boosted by lower mortgage rates, which reflect the Federal Reserve's moves to keep the benchmark short-term interest rate at nearly zero.

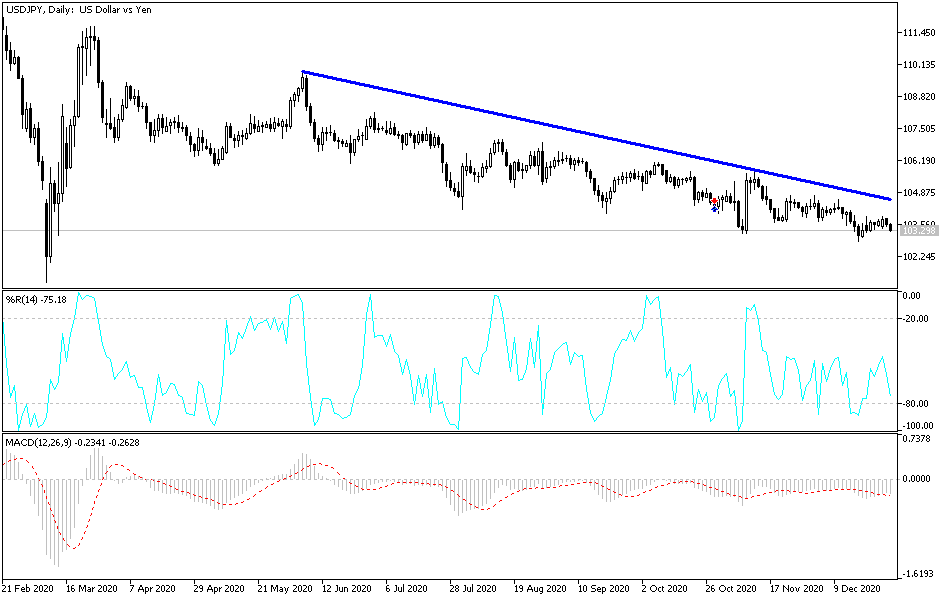

Technical analysis of the pair:

The USD/JPY pair is still in its downward path, and in the event that the psychological support level 103.00 is breached, the technical indicators will move towards strong oversold areas. There may be buying opportunities once we see a rebound, which is what I expect instead of a sell-off which would take the currency pair to stronger descending levels. The most suitable buying levels are at 103.10, 102.55 and 101.90 respectively. On the upside, there will be no real breach of the current trend without bulls pushing the currency pair to the 106.00 resistance as a first stop for an upward correction. In addition to investors’ risk appetite, the currency pair will interact with US data, including the commodity trade balance, pending home sales and the Chicago PMI reading.