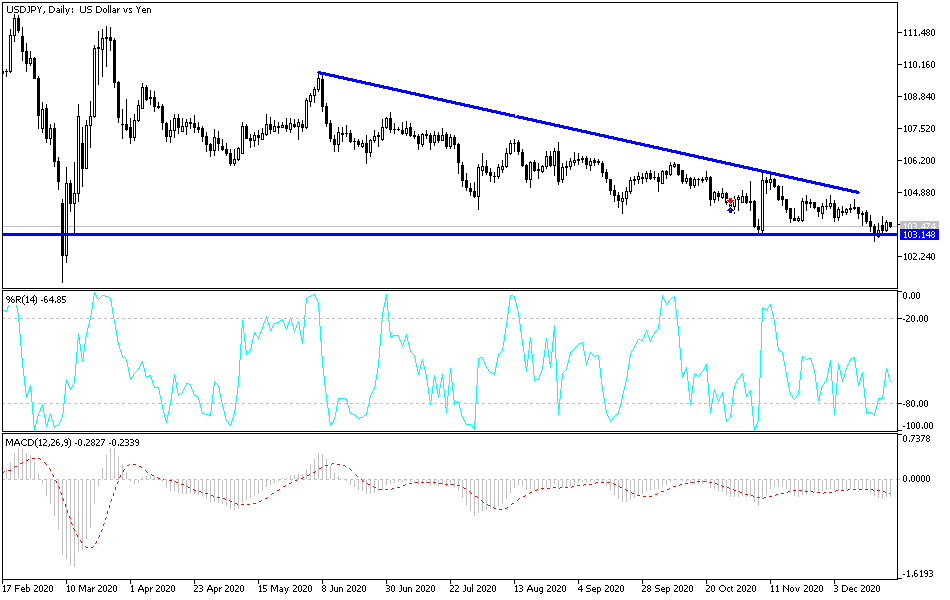

Clearly, the USD/JPY performance is determined to end the 2020 trading year on a bearish note. The pair was not affected much by the US stimulus bill approval, the announcement of coronavirus vaccines, nor even the results of the US economic data, which are being intensified ahead of the Christmas and New Year holidays. Since the beginning of trading this week, the currency pair has been stable in a descending range between the 103.88 resistance and the 103.03 support, and it is stabilizing around 103.45 at the time of this writing, before the announcement of the latest US economic data package.

With lack of liquidity during the holiday week aside, the disruption of stock markets and risk currencies is the result of uncertainty about whether the new strain of the coronavirus will respond to any of the vaccines on which investors are pinning their hopes regarding expectations of a strong economic recovery in 2021.

“A new strain of the virus that is more transmissible and the tightening of lockdowns has undermined confidence in how quickly economies - especially in Europe - can get back on their feet,” said Chris Turner, Regional Director of Forex Research at ING. So far, the news has only delayed expectations for a recovery and demanded a modest correction, and as long as the rates of the vaccine effectiveness are not crucially questioned, we believe that the policy is very stimulative (it appears that the US Congress will sign a stimulus package worth $900 billion) and that should limit the negative side of active currencies, and the uptrend of the USD. Let's see if this rally in ``the USD DXY Index stops at 90.50.

The US economy saw a record annual rate of 33.4% from July to September, as the last three estimates of the economy’s performance were provided in the third quarter. But it is likely that the emergence of COVID-19 cases will slow growth sharply during the last three months of 2020. The July-September growth spurt - which was slightly upgraded from the previous trade estimate of 33.1%, as reported last month – witnessed a sharp recovery from a second quarter drop of 31.4%, the worst in history dating back to 1947, when the COVID-19 pandemic hit hard in mid-March.

Technical analysis of the pair:

So far, the USD/JPY is still struggling with catalysts to break out of its sharp bearish channel. As I mentioned before, there will be no technical opportunity for an initial change in this trend without the pair moving towards the 106.00 resistance. According to the current performance, stability around and below the 104.00 support will continue to stimulate the bears to control the performance, and thus prepare to test stronger support levels, the most important of which are currently at 102.90, 102.00 and 101.25, respectively. At the same time, those levels push the technical indicators into strong oversold areas.

Therefore, Forex traders are waiting for the opportunity to buy instead of preparing for further selling.

The focus of the pair today is going to be on the results of the US economic data, the most prominent of which is the reading of the Personal Consumption Expenditure Price Index - the Fed’s preferred measure of US inflation - as well as the average income and spending of American citizens, durable goods orders, unemployed claims and new home sales.