Despite official US approval for distribution of the Pfizer vaccine, the USD/JPY continued its downward path at the beginning of this week's trading. The pair reached the 103.51 support, its lowest in over a month, before settling around 104.10 at the time of writing. The bears' performance is still the strongest. The performance of the US dollar may remain as is until the decisions of the US Federal Reserve meeting on Wednesday are announced.

The US central bank policy meeting coincides with the shattering resurgence of the coronavirus, causing increased trade restrictions and making more Americans hesitant to shop, travel and eat outside. Some analysts say that the US economy may contract in early 2021 before it recovers as vaccines combat the COVID-19.

In general, economists are divided over whether the Fed will announce any new measures this week. One of the options policymakers could take is to announce a shift in bond purchases by the Fed. The bank was buying $80 billion in Treasury bonds and $40 billion in mortgage bonds every month in an effort to keep borrowing rates low.

Amid continued record numbers of coronavirus infections in the United States and the return of restrictions on economic activity to contain the new outbreak, Congress has yet to agree on another round of badly needed financial aid for millions of unemployed Americans, thousands of struggling companies and cash-strapped states and cities.

Accordingly, many Fed policymakers, including Chairman Jerome Powell, have repeatedly urged Congress to provide more support. Most of the proposals on Capitol Hill include extending unemployment benefits programs that are due to expire in about two weeks. At that stage, nearly 9 million unemployed people will lose all unemployment aid, whether governmental or federal.

"They are all looking to the fiscal stimulus," said Tim Dooe, a professor of economics at the University of Oregon and author of the "Fed Watch" blog, referring to potential bailout aid from Congress.

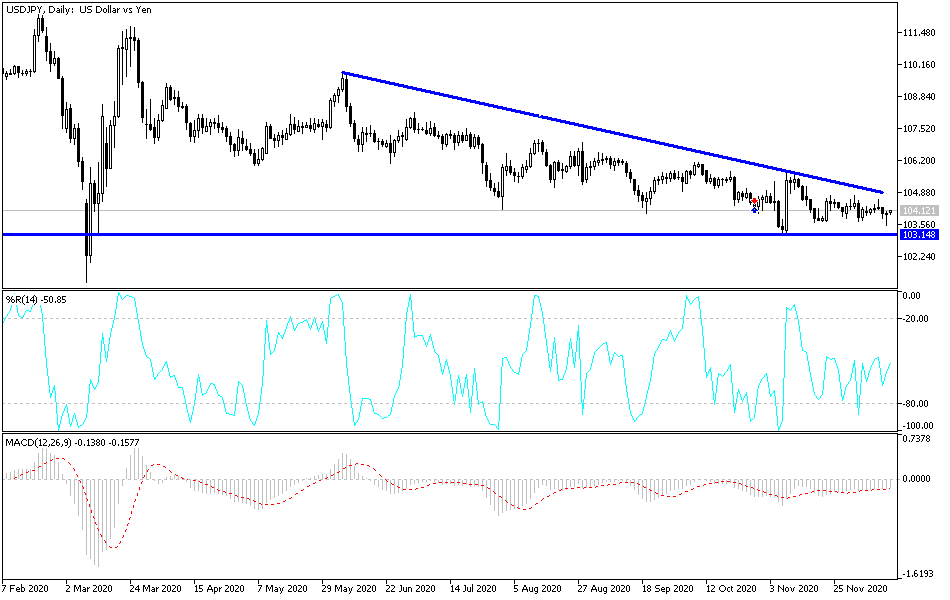

Technical analysis of the pair:

Until now, the general trend of the USD/JPY remains bearish as long as it is stable around and below the 104.00 support. At the same time, I still see that buying the pair from the current descending levels is better than selling. I find that the support levels most suitable for buying are currently 103.65, 103.00 and 102.45, respectively. As I mentioned before, the bulls will not have a chance to dominate the performance without the currency pair moving towards the 106.00 resistance. Technical indicators on the daily chart are still pointing to oversold areas. In addition to the extent of investors’ risk appetite, the currency pair will interact with the results of US economic data, which include the reading of the Empire State Industrial Index and the US industrial production rate.