For three trading sessions in a row, the USD/JPY currency pair has been trying to correct higher. The retracement gains are still weak, however, as they did not exceed the 104.58 level before settling around 104.47 at the time of writing. There was fresh disappointment for the USD after US Treasury Secretary Stephen Mnuchin defended his decision to close a number of emergency federal loan programs. However, Democrats were not convinced, saying that Mnuchin's actions were politically motivated and aimed at removing tools that the Biden administration could use to support the US economy.

Mnuchin argued that the federal loan programs, which he decided not to extend to 2021, are being used sparingly. He said the $455 billion earmarked for those federal loan programs could be better used elsewhere if Congress would funnel the money to relief programs for small businesses and unemployed workers. Democrats aired their criticism on Tuesday when Mnuchin and Fed Chairman Jerome Powell testified at a Senate Banking Oversight Committee session on the $2 trillion CARES bill that Congress approved last March.

Powell has urged Congress again to allow more economic support, something lawmakers have been struggling to do for months. A bipartisan group of congressmen pressed Congress leaders on Tuesday to reach a compromise and end the impasse ahead of the annual holiday season. The group includes senators like Joe Mansheen (D-WV) and Susan Collins (R-ME), who are pushing a $908 billion measure, including $228 billion to extend and upgrade "salary protection" benefits for a second round of relief.

It would revive private unemployment benefits, but at a reduced level of $300 per week, is half of the amount provided in March. State and local governments would get $160 billion, and there is also money for vaccines.

Powell told the committee to think of additional relief as a "bridge" to move the economy from its current situation with a high number of virus cases to a period when vaccines are widely distributed. "We can see the end," Powell added, “And we just need a way to get there." In his opening testimony, Powell described the current economic outlook as "extraordinarily uncertain."

Jerome Powell has promised once again that the Fed will do everything it can to support the economic recovery.

Treasury Secretary Mnuchin said the CARES Act that allowed the creation of the five loan programs did not give him the authority to extend them after December 31. The US Treasury and the Federal Reserve announced that four other lending programs used by the Fed will be extended through March. These facilities helped stabilize short-term financing markets when the coronavirus broke out last spring, sending shock waves to the financial system.

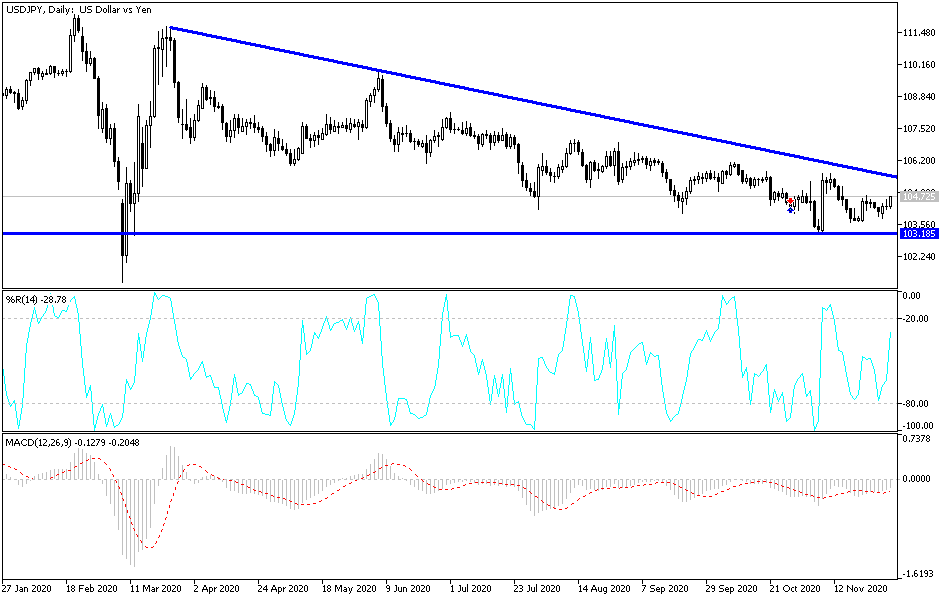

Technical analysis of the pair:

According to the performance on the daily chart, there is a state of relative stability in the USD/JPY pair. However, the bears' control over the performance is still in place, and the real upward shift of the trend might happen by breaking the 106.00 resistance as a first stage. On the downside, stability below the 104.00 support is still a catalyst for the bears to continue controlling the performance. The pair would then move towards stronger support levels from which buying is preferred, with the closest ones currently at 103.90, 103.20 and 102.55. In addition to the extent of investor risk appetite, the currency pair will be affected today by the announcement of the ADP reading of the change in US non-farm payrolls and a second testimony from Jerome Powell.