The USD collapse continued amid the weak performance of the US economy, the stumbling of stimulus negotiations and the wave of risk appetite that dominates global financial markets with the beginning of COVID-19 vaccinations. These factors contributed to sharp losses in the ÙSD/JPY pair, and it reached the 103.24 support at the time of this writing, near its lowest level since last March when the market collapsed and there was a record liquidity weakness at the height of the first coronavirus wave.

Since then, the tremendous efforts made by the US Federal Reserve have helped support the market since the spring. Yesterday, the US central bank said it would buy at least $80 billion in Treasury bonds per month and $40 billion in mortgage-backed securities for the agency until it achieves "another major advance." It also said again that it would keep short-term interest rates at a record-low, near zero.

Commenting on this, economists, investors and even Fed officials say that more support is crucial, because Fed tools alone can help the economy only so much. Low interest rates initiated by the Fed could help raise home and stock prices on Wall Street, for example, but they cannot replace lost pay checks for workers whose businesses have shut down due to the pandemic.

Yesterday, an important report showed that US retail sales tumbled 1.1% last month, the second consecutive month of weakness and much worse than the 0.3% decline that economists had expected. As restaurants recorded a sharp drop in sales, the numbers could get worse as winter sets in, discouraging outdoor dining which is the only option for many communities. As such, governments around the world are working to bring back varying degrees of restrictions on companies to slow the spread of the virus. Even without lockdowns, the high toll of deaths and cases scare customers away from business and normal economic activity.

Generally speaking, if the US Congress has already managed to reach an agreement, it may help propel the economy through what is expected to be a bleak winter, before one or more coronavirus vaccines help the economy get closer to normal next year.

The collapse of the dollar helped Bitcoin, the world's largest cryptocurrency, surpass the $20,000 mark for the first time. It was trading up 4.9% at $21955.

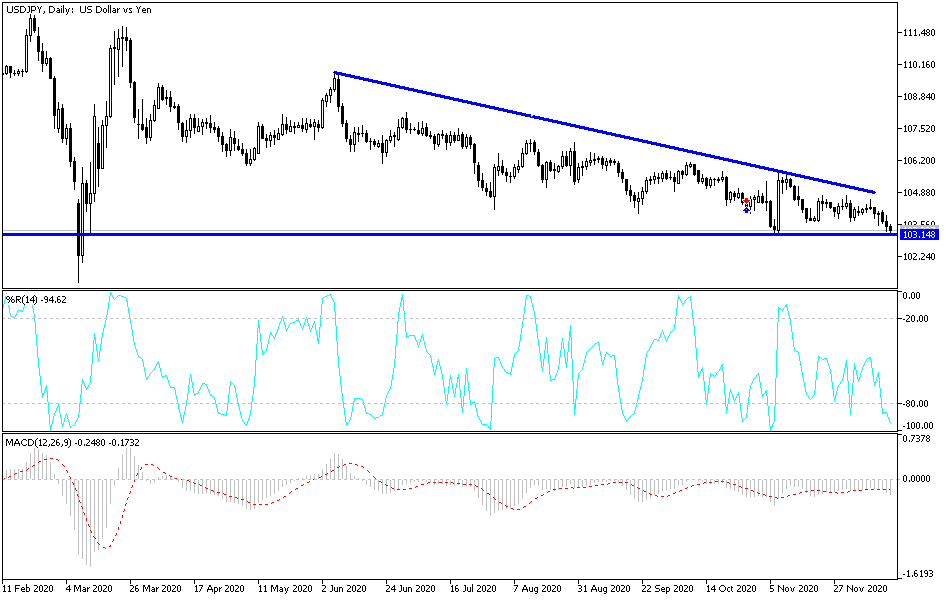

Technical analysis of the pair:

The downtrend of the USD/JPY is getting stronger with the failure of the US dollar to obtain any support, whether from passing stimulus plans, the Federal Reserve's policy, or the continuing record numbers of COVID-19 infections and deaths in the U.S. In addition to weak economic data results, the pair is closer currently to testing psychological support at 103.00. Despite this performance, I still prefer to buy from every descending level, waiting for a rebound. Technical indicators touch sharp oversold levels. The closest support levels for the pair are currently at 102.90, 102.45 and 101.90, respectively. On the upside, as I mentioned before, there will be no real initial opportunity to break the current bearish outlook without breaking the 106.00 resistance.

The pair today awaits the US housing market numbers, building permits and housing starts, and then reading the Philadelphia Industrial Index and the weekly jobless claims, along with investor’s risk appetite.