For nearly a month, the 104.00 support level has been important for the USD/JPY performance. That level stimulates Forex traders to consider buying by waiting for an upward correction. During last week’s trading, the currency pair collapsed towards the 103.67 support and closed the week’s trading around 104.18, amid the bears' domination of the pair's performance.

President Trump recently added more Chinese companies to the blacklist in an expansion of his overall trade dispute with China. Despite the pandemic, ways to stimulate the US economy remain complex.

Japanese Prime Minister Yoshihide Suga has pledged 2 trillion yen ($19 billion) in financing to boost environmental businesses and innovation to achieve his goal of zero net carbon emissions by 2050. Suga, who took office in mid-September, has put climate change as one of his main policy goals besides promoting the digital transformation of Japanese society - issues left by his predecessor, Shinzo Abe, who resigned due to his poor health. In this regard, Suga said: "The fund aims to promote environmental investment because we aim to become global leaders in this field."

He pledged to achieve carbon neutrality by 2050 in a policy speech in October, although it will be a major challenge given Japan's heavy reliance on fossil fuels.

In his first full press conference since taking office, Suga said on Friday that his government plans next week to approve an economic package that also includes 1 trillion yen ($9.5 billion) to boost the country's digital transformation, a weakness Japan has recognized. When companies were asked to allow employees to work from home in response to the coronavirus, many were unable to do so.

Although he is known for his pragmatic approach to getting things done, it is unclear whether Suga has the political leverage to overcome vested interests in weaning the resource-poor country from its dependence on imported oil and gas. He said Japan needs to strive to become a global leader in achieving carbon neutrality, and that investing in the environment is an opportunity for growth, not a burden.

Suga reiterated that he plans to deepen Japan's alliance with the United States and advance the vision of a "free and open Indian Ocean region" to counter the growing Chinese influence in the region. At the moment, as Japan struggles to cope with the rising number of COVID-19 cases nationwide, Suga said balancing the epidemic control and protecting the economy will remain his main focus.

Employment in the United States has slowed sharply. Hundreds of thousands of people have given up looking for work. Accordingly, the percentage of the unemployed who have been without work for at least six months has increased. The US Labor Department announced that employers added 245,000 jobs in November - the lowest number since April, the fifth consecutive monthly slowdown and well below gains economists had expected.

Going back to March and April when the COVID-19 virus hit the economy, the United States lost 22 million jobs. President Trump managed to reclaim over 11 million of those jobs, though the rate is steadily diminishing: 4.8 million more jobs in June, 1.8 million in July, 1.5 million in August, 711,000 in September, 610,000 in October and 245,000 in November. .

In total, the US economy is still short of 9.8 million jobs in February.

Meanwhile, the coronavirus outbreak continues to have a negative impact. The nation now suffers an average of 189,000 new confirmed infections per day, up from less than 35,000 three months ago. Currently, states and localities impose restrictions on businesses and convince more Americans to stay home, which means spending less money and less jobs.

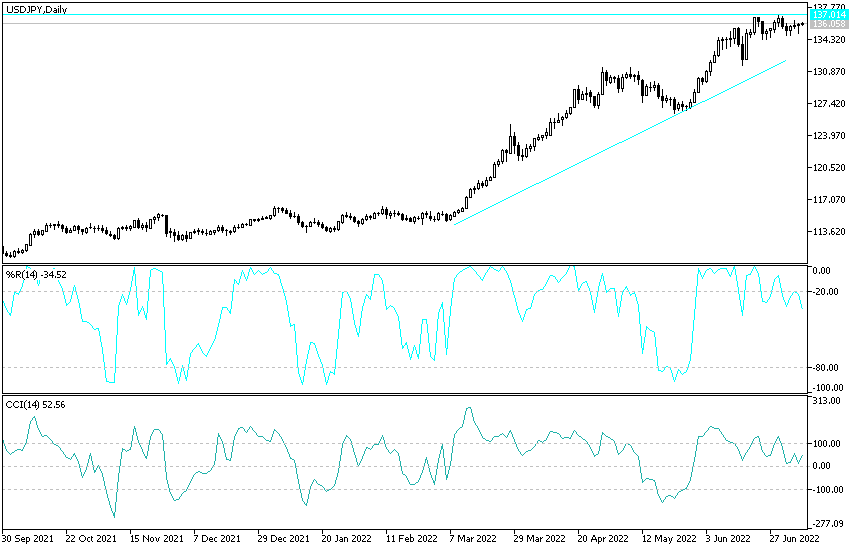

Technical analysis of the pair:

There is no change in my technical view of the USD/JPY, as bears still have a stronger dominance, which is especially clear on the daily chart. Stability below the 104.00 support portends a move towards stronger support levels. The closest ones are currently 103.75, 103.20 and 102.45, respectively. On the upside, according to performance over the same period of time, the 106.00 resistance is still the first stop for the bulls to start controlling performance.

Today's economic calendar:

For the yen, the leading indicators reading will be announced, and at the beginning of Tuesday, the average wages, rate of Japanese household spending, current accounts, and the Japanese economy growth rate will be announced. There is no significant US economic data expected today.