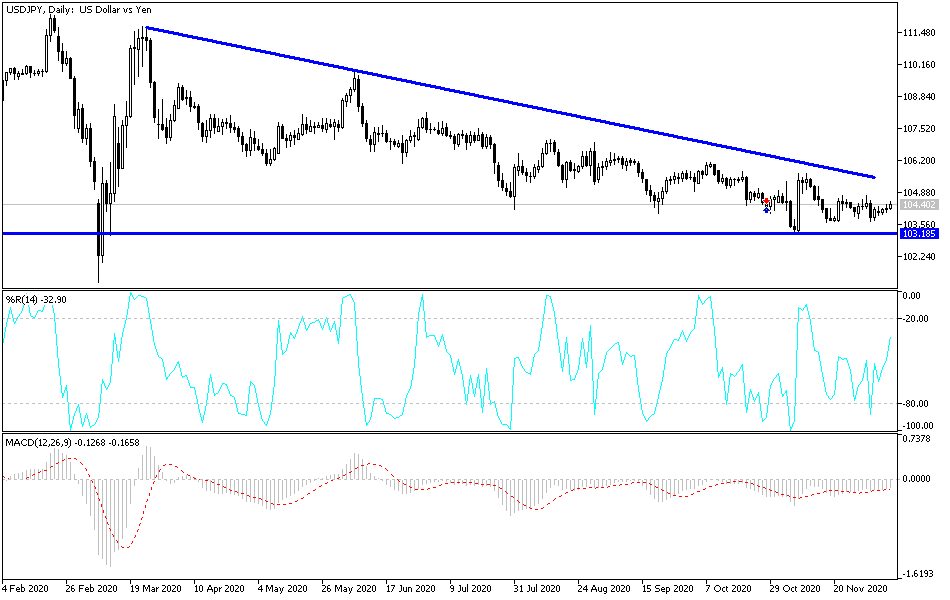

For three trading sessions in a row, the USD/JPY currency pair has been trying to correct upwards. However, the retracement gains did not exceed the 104.50 level, where the pair is stable at the time of this writing. The beginning of this week was bearish, as the currency pair settled around the support level at 103.90. The pair still lacks sufficient momentum to exit its sharp bearish channel. Forex investors are still dispensing the US currency since the announcement of the coronavirus vaccines. The markets are currently waiting for the approval of more stimulus plans to revive the US economy in the face of the pandemic.

All in all, lawmakers are still spinning their wheels around COVID-19 relief, and have secured a one-week extension of government funding that saves time for further talks - although there is a major disagreement over who should take the lead. Amidst the uncertainty, the House of Representatives readily passed a one-week government-wide funding bill on Wednesday. The bill sets a new deadline of December 18 for the US Congress to pass both the COVID-19 relief measure and the also overdue $1.4 trillion package spending bill. The 343-67 vote sent the one-week bill to the Senate, where it is expected to pass easily before the deadline at Friday midnight to avoid a partial government shutdown.

The measure should give lawmakers more time to sort through the hot mess they have created for themselves after months of negotiations, futile positions and recent rounds of volatility.

In this regard, senior Republican Party leaders said that the right people to deal with the endgame negotiations are the big four leaders in Congress and the Trump administration, and they focused on a proposal by Senate Majority Leader Mitch McConnell to cancel Democrats’ demand for an aid package of $160 billion or so for state and local governments.

Top Democrats are placing their bets on a group of senators from both parties who are trying to settle a deal worth $908 billion. The bipartisan group did not get any encouragement from McConnell, but members are calling for progress on the most controversial element, which is a demand by the Kentucky Republican that companies and other organizations be given protection against lawsuits related to COVID.

Senior Congressional Democrats recently admitted that their party shot down the Trump administration's proposed $1.8 trillion relief bill in October due to political reasons, citing the presidential election.

US President-elect Joe Biden is pressing for the greatest possible relief from the pandemic, although he is not directly participating in the talks. McConnell says Congress will not postpone the session without providing the long-awaited relief from COVID-19. The pressure to deliver is intense and all parties say failure is not an option.

The number of new coronavirus infections in the Japanese capital exceeded 600 in one day for the first time. Experts with the Tokyo Virus Task Force say that the increase in the number of infections has placed an additional burden on hospitals, making it difficult for many of them to treat ordinary patients. Tokyo reported 602 new cases on Thursday, while the daily number for the entire nation was 2,810. Japan has reported 168,573 infections since the beginning of the epidemic, with 2,465 deaths.

About 50% of Americans will receive a new coronavirus vaccine, according to an Associated Press - NORC Public Affairs Research Centre poll. About 25% of adults in the United States are not sure whether they want to be vaccinated or not, and health regulators in Canada approved the Pfizer vaccine, days before possible approval in the United States. In this regard, the Canadian Ministry of Health says that 249,000 doses of the vaccine produced by the American pharmaceutical company Pfizer and the German company BioNTech will arrive this month and will be given within days.

Technical analysis of the pair:

Even with recent gains of the USD/JPY, the general trend remains downward as long as it remains stable around and below the 104.00 support. This confirms the continued control of the bears over the performance and the willingness to test stronger support levels, the closest of which are currently 103.75, 103.20 and 102.45. We prefer to buy from these levels because it will push the technical indicators to oversold areas. As I mentioned before, I confirm now that moving towards the 106.00 resistance will be the first way for the bulls to return to control and start exiting the sharp descending channel. Today, the pair will be affected by the release of the US inflation figures for the Consumer Price Index, along with the number of weekly jobless claims.